Frontier Communications 2009 Annual Report Download - page 74

Download and view the complete annual report

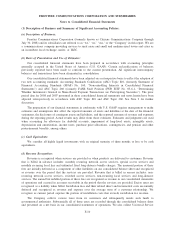

Please find page 74 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(k) Stock Plans:

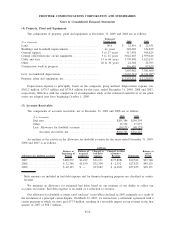

We have various stock-based compensation plans. Awards under these plans are granted to eligible

officers, management employees, non-management employees and non-employee directors. Awards may be

made in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted

stock, restricted stock units or other stock-based awards. We have no awards with market or performance

conditions. Our general policy is to issue shares upon the grant of restricted shares and exercise of options from

treasury.

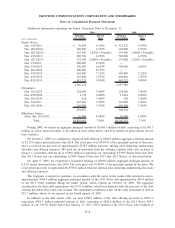

The compensation cost recognized is based on awards ultimately expected to vest. ASC Topic 718 requires

forfeitures to be estimated and revised, if necessary, in subsequent periods if actual forfeitures differ from those

estimates.

(l) Net Income Per Common Share Attributable to Common Shareholders:

Basic net income per common share is computed using the weighted average number of common shares

outstanding during the period being reported on, excluding unvested restricted stock awards. The impact of

dividends paid on unvested restricted stock awards have been deducted in the determination of basic and

diluted net income attributable to common shareholders of Frontier. Except when the effect would be

antidilutive, diluted net income per common share reflects the dilutive effect of the assumed exercise of stock

options using the treasury stock method at the beginning of the period being reported on as well as common

shares that would result from the conversion of convertible preferred stock (EPPICS) and convertible notes. In

addition, the related interest on convertible debt (net of tax) is added back to income since it would not be paid

if the debt was converted to common stock.

(2) Recent Accounting Literature and Changes in Accounting Principles:

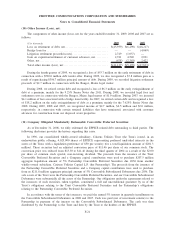

Fair Value Measurements

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (currently ASC Topic

820), which defines fair value, establishes a framework for measuring fair value, and expands disclosures about

fair value measurements. In February 2008, the FASB amended SFAS No. 157 (ASC Topic 820) to defer the

application of this standard to nonfinancial assets and liabilities until 2009. The provisions of SFAS No. 157

(ASC Topic 820) related to financial assets and liabilities were effective as of the beginning of 2008. Our

partial adoption of SFAS No. 157 (ASC Topic 820) in the first quarter of 2008 had no impact on our financial

position, results of operations or cash flows. The adoption of SFAS No. 157 (ASC Topic 820), as amended, in

the first quarter of 2009 with respect to its effect on nonfinancial assets and liabilities had no impact on our

financial position, results of operations or cash flows.

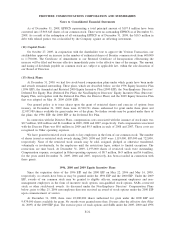

Business Combinations

In December 2007, the FASB revised SFAS No. 141, “Business Combinations” (currently ASC Topic

805). The revised statement, SFAS No. 141R (ASC Topic 805), as amended by FSP SFAS No. 141(R)-1 (ASC

Topic 805), requires an acquiring entity to recognize all the assets acquired and liabilities assumed in a

transaction at the acquisition date at fair value, to recognize and measure preacquisition contingencies,

including contingent consideration, at fair value (if possible), to remeasure liabilities related to contingent

consideration at fair value in each subsequent reporting period and to expense all acquisition related costs. The

effective date of SFAS No. 141R (ASC Topic 805) was for business combinations for which the acquisition

date was on or after the beginning of the first annual reporting period beginning on or after December 15, 2008.

We will account for our pending acquisition of approximately 4.2 million access lines (as of December 31,

2009) from Verizon Communications Inc. (Verizon) using the guidance included in SFAS No. 141R (ASC

Topic 805). For the year ended December 31, 2009, we incurred approximately $28.3 million of acquisition and

integration costs in connection with our pending acquisition from Verizon. In accordance with SFAS No. 141R

F-12

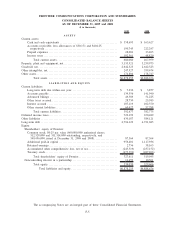

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements