Frontier Communications 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

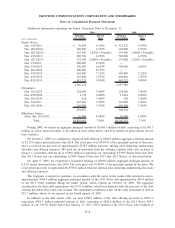

quarter of 2007, we completed an exchange offer (to publicly register the debt) for the $750.0 million in total

of private placement notes described above, in addition to the $400.0 million principal amount of 7.875%

Senior Notes issued in a private placement on December 22, 2006, for registered Senior Notes due 2027. On

April 26, 2007, we redeemed $495.2 million principal amount of our 7.625% Senior Notes due 2008 at a price

of 103.041% plus accrued and unpaid interest. The debt retirement generated a pre-tax loss on the early

extinguishment of debt at a premium of approximately $16.3 million in the second quarter of 2007 and is

included in other income (loss), net. As a result of this debt redemption, we also terminated three interest rate

swap agreements hedging an aggregate $150.0 million notional amount of indebtedness. Payments on the swap

terminations of approximately $1.0 million were made in the second quarter of 2007.

As of December 31, 2009, we were in compliance with all of our debt and credit facility financial

covenants.

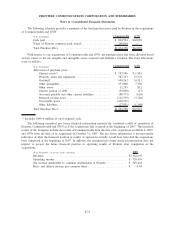

Our principal payments for the next five years are as follows:

($ in thousands)

Principal

Payments

2010............................................................................. $ 7,236

2011............................................................................. $279,956

2012............................................................................. $180,366

2013............................................................................. $709,855

2014............................................................................. $600,517

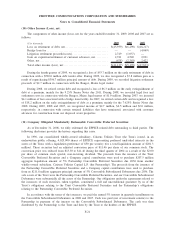

(8) Derivative Instruments and Hedging Activities:

Interest rate swap agreements were used to hedge a portion of our debt that is subject to fixed interest

rates. Under our interest rate swap agreements, we agreed to pay an amount equal to a specified variable rate of

interest times a notional principal amount, and to receive in return an amount equal to a specified fixed rate of

interest times the same notional principal amount. The notional amounts of the contracts were not exchanged.

No other cash payments are made unless the agreement is terminated prior to maturity, in which case the

amount paid or received in settlement is established by agreement at the time of termination and represents the

market value, at the then current rate of interest, of the remaining obligations to exchange payments under the

terms of the contracts.

On January 15, 2008, we terminated all of our interest rate swap agreements representing $400.0 million

notional amount of indebtedness associated with our Senior Notes due in 2011 and 2013. Cash proceeds on the

swap terminations of approximately $15.5 million were received in January 2008. The related gain has been

deferred on the consolidated balance sheet, and is being amortized into interest expense over the term of the

associated debt. For the years ended December 31, 2009 and 2008, we recognized $7.6 million and $5.0

million, respectively, of deferred gain and anticipate recognizing $1.0 million during 2010. For the year ended

December 31, 2007, the interest expense resulting from these interest rate swaps totaled approximately $2.4

million. At December 31, 2009 and 2008, we did not have any derivative instruments.

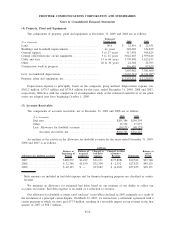

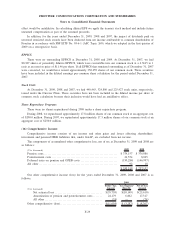

(9) Investment Income:

The components of investment income for the years ended December 31, 2009, 2008 and 2007 are as

follows:

($ in thousands) 2009 2008 2007

Interest and dividend income ...................................... $5,291 $10,928 $32,986

Equity earnings................................................... 994 5,190 4,655

Total investment income .......................................... $6,285 $16,118 $37,641

F-20

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements