Frontier Communications 2009 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.transactions that occurred after the balance sheet date. SFAS No. 165 (ASC Topic 855) was effective for

interim or annual reporting periods ending after June 15, 2009. The adoption of SFAS No. 165 (ASC Topic

855) in the second quarter of 2009 had no impact on our financial position, results of operations or cash flows.

Accounting Standards Codification

In June 2009, the FASB issued SFAS No. 168, “The FASB Accounting Standards Codification and the

Hierarchy of Generally Accepted Accounting Principals” (currently ASC Topic 105). SFAS No. 168 (ASC

Topic 105) replaces the guidance that previously existed in SFAS No. 162, entitled “The Hierarchy of

Generally Accepted Accounting Principals” and designates the FASB Accounting Standards Codification as the

sole source of authoritative accounting technical literature for nongovernmental entities. All accounting

guidance that is not included in the Accounting Standards Codification is now considered to be non-

authoritative. SFAS No. 168 (ASC Topic 105) was effective for financial statements issued for interim and

annual periods ending after September 15, 2009. The adoption of SFAS No. 168 (ASC Topic 105) in the third

quarter of 2009 had no impact on our financial position, results of operations or cash flows.

(3) Acquisitions:

Pending Acquisition

On May 13, 2009, we entered into a definitive agreement with Verizon under which Frontier will acquire

defined assets and liabilities of the local exchange business and related landline activities of Verizon, including

Internet access and long distance services and broadband video provided to designated customers. Assuming

that the merger occurred on December 31, 2009, the merger would have resulted in Frontier acquiring

approximately 4.2 million access lines and certain business related assets from Verizon. The Verizon

Transaction will be financed with approximately $5.3 billion of common stock plus the assumption of

approximately $3.33 billion in debt. Certain of the conditions to the closing of the Verizon Transaction have

already been met: (1) Frontier’s shareholders approved the Verizon Transaction at a special meeting of

shareholders held on October 27, 2009; (2) the Federal Trade Commission has granted early termination of the

waiting period under the Hart-Scott-Rodino Act; (3) approvals of all necessary local video franchise authorities

(subject to the satisfaction of certain conditions); (4) receipt by Verizon of a favorable ruling from the IRS

regarding the tax consequences of the Verizon Transaction; and (5) five of the nine required state regulatory

approvals. Completion of the Verizon Transaction remains subject to a number of other conditions, including

the receipt of the remaining four state regulatory approvals, approval from the FCC, the completion of

financing, on terms that satisfy certain conditions as well as other customary closing conditions. Subject to

satisfaction of these conditions, we anticipate closing this transaction during the second quarter of 2010.

Acquisitions of Commonwealth Telephone and Global Valley Networks

On March 8, 2007, we acquired Commonwealth Telephone Enterprises, Inc. (“Commonwealth” or “CTE”)

in a cash-and-stock taxable transaction, for a total consideration of approximately $1.1 billion. We paid $804.1

million in cash ($663.7 million net, after cash acquired) and issued common stock with a value of $249.8

million.

On October 31, 2007, we acquired Global Valley Networks, Inc. and GVN Services (together GVN)

through the purchase from Country Road Communications, LLC of 100% of the outstanding common stock of

Evans Telephone Holdings, Inc., the parent Company of GVN. The purchase price of $62.0 million was paid

with cash on hand.

We have accounted for the acquisitions of Commonwealth and GVN as purchases under U.S. GAAP.

Under the purchase method of accounting, the assets and liabilities of Commonwealth and GVN were recorded

as of their respective acquisition dates, at their respective fair values, and consolidated with those of Frontier.

F-14

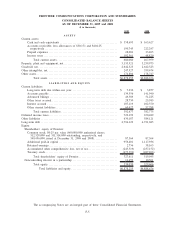

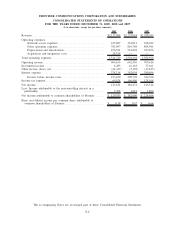

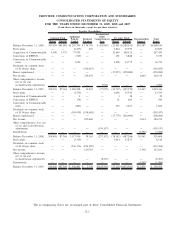

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements