Frontier Communications 2009 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

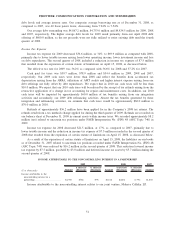

Severance and early retirement costs of $13.9 million in 2007 include a third quarter charge of

approximately $12.1 million related to initiatives to enhance customer service, streamline operations and reduce

costs. Approximately 120 positions were eliminated as part of this 2007 initiative, most of which were filled by

new employees at our remaining call centers. In addition, approximately 50 field operations employees agreed

to participate in an early retirement program and another 30 employees from a variety of functions left the

Company in 2007.

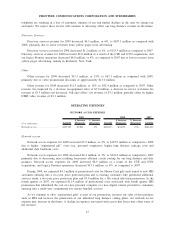

Stock based compensation

Stock based compensation for 2009 increased $1.6 million, or 20%, to $9.4 million as compared with

2008, due to increased costs for restricted stock awards.

Stock based compensation for 2008 decreased $1.2 million, or 14%, as compared to 2007 due to reduced

costs associated with stock units and stock options.

All other operating expenses

All other operating expenses for 2009 decreased $38.3 million, or 9%, to $373.2 million as compared to

2008, due to reduced costs for outside contractors and other vendors, as well as lower fuel, travel and USF

surcharges, partially offset by slightly higher marketing expenses.

All other operating expenses for 2008 increased $7.2 million, or 2%, to $411.5 million as compared to

2007, primarily due to the additional expenses attributable to the CTE and GVN acquisitions of $10.0 million

in 2008 versus 2007, as 2008 includes a full year of expenses for CTE and GVN while 2007 included

approximately ten months of costs for CTE and two months of costs for GVN. Our purchase of CTE has

enabled us to realize cost savings by leveraging our centralized back office, customer service and

administrative support functions over a larger customer base.

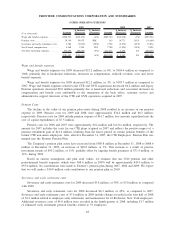

DEPRECIATION AND AMORTIZATION EXPENSE

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2009 2008 2007

Depreciation expense . . . . . . . . . . . . . . . . . $362,228 $(17,262) (5%) $379,490 $ 5,055 1% $374,435

Amortization expense . . . . . . . . . . . . . . . . 114,163 (68,148) (37%) 182,311 10,890 6% 171,421

$476,391 $(85,410) (15%) $561,801 $15,945 3% $545,856

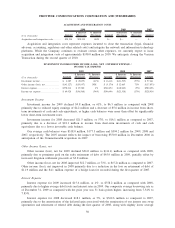

Depreciation and amortization expense for 2009 decreased $85.4 million, or 15%, to $476.4 million as

compared to 2008. The decrease is primarily due to reduced amortization expense, as discussed below, and a

declining net asset base, partially offset by changes in the remaining useful lives of certain assets. An

independent study updating the estimated remaining useful lives of our plant assets is performed annually. We

revised our useful lives based on the study effective October 1, 2009. Our “composite depreciation rate”

decreased from 5.6% to 5.2% as a result of the study. We anticipate depreciation expense of approximately

$335.0 million to $355.0 million and amortization expense of approximately $56.2 million for 2010 related to

our currently owned properties.

Amortization expense for 2009 is comprised of $57.9 million for amortization associated with our legacy

Frontier properties, which were fully amortized in June 2009, and $56.3 million for intangible assets (customer

base and trade name) that were acquired in the Commonwealth and Global Valley acquisitions. Amortization

expense for our legacy Frontier properties was $126.4 million for 2008 and 2007.

Depreciation and amortization expense for 2008 increased $15.9 million, or 3%, to $561.8 million as

compared to 2007. Depreciation and amortization expense increased $26.6 million as a result of the CTE and

GVN acquisitions, and decreased $10.7 million, or 2%, as compared to 2007, primarily due to a declining net

asset base for our legacy Frontier properties, partially offset by changes in the remaining useful lives of certain

assets.

49

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES