Frontier Communications 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

EIPs generally are equal to or greater than the fair market value of the underlying common stock on the date of

grant. Stock options are not ordinarily exercisable on the date of grant but vest over a period of time (generally

four years). Under the terms of the EIPs, subsequent stock dividends and stock splits have the effect of

increasing the option shares outstanding, which correspondingly decrease the average exercise price of

outstanding options.

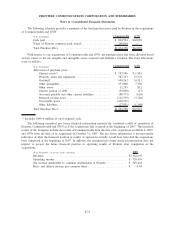

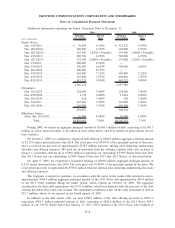

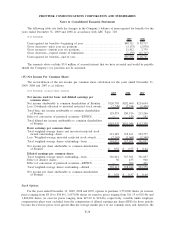

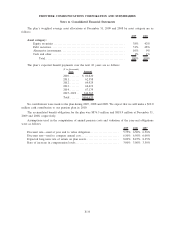

The following summary presents information regarding outstanding stock options and changes with regard

to options under the EIP:

Shares

Subject to

Option

Weighted

Average

Option Price

Per Share

Weighted

Average

Remaining

Life in Years

Aggregate

Intrinsic

Value

Balance at January 1, 2007 . . . ...................... 5,242,000 $12.41 4.4 $14,490,000

Options granted . . ............................... — $ —

Options exercised. ............................... (1,254,000) $10.19 $ 6,033,000

Options canceled, forfeited or lapsed ............. (33,000) $10.79

Balance at December 31, 2007 ..................... 3,955,000 $13.13 3.4 $ 5,727,000

Options granted . . ............................... — $ —

Options exercised. ............................... (187,000) $ 7.38 $ 743,000

Options canceled, forfeited or lapsed ............. (55,000) $10.40

Balance at December 31, 2008 ..................... 3,713,000 $13.46 2.5 $ 495,000

Options granted . . ............................... — $ —

Options exercised. ............................... (114,000) $ 6.58 $ 65,000

Options canceled, forfeited or lapsed ............. (48,000) $ 9.24

Balance at December 31, 2009 ..................... 3,551,000 $13.74 1.5 $ —

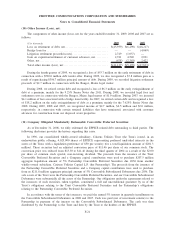

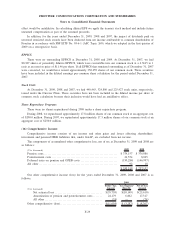

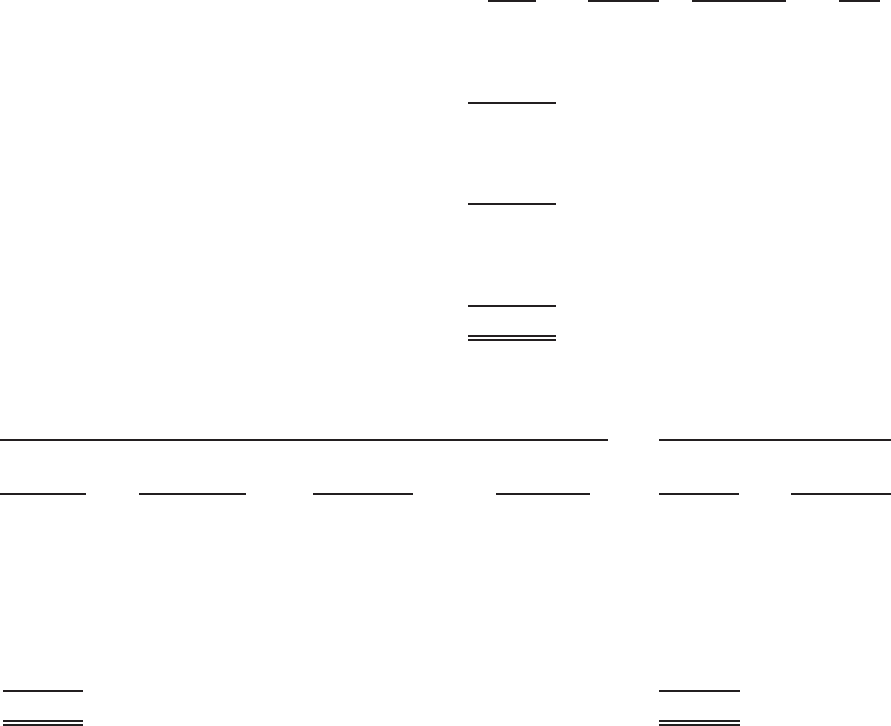

The following table summarizes information about shares subject to options under the EIP at December 31,

2009:

Number

Outstanding

Range of

Exercise Prices

Weighted Average

Exercise Price

Weighted Average

Remaining

Life in Years

Number

Exercisable

Weighted

Average

Exercise Price

Options Outstanding Options Exercisable

394,000 $ 8.19–8.19 $ 8.19 2.37 394,000 $ 8.19

511,000 10.44–10.44 10.44 3.4 511,000 10.44

199,000 11.15–11.15 11.15 0.8 199,000 11.15

476,000 11.79–11.79 11.79 1.38 476,000 11.79

167,000 11.90–14.27 13.44 3.77 166,000 13.44

582,000 15.02–15.02 15.02 0.75 582,000 15.02

640,000 15.94–16.74 16.67 0.73 640,000 16.67

582,000 18.46–18.46 18.46 0.75 582,000 18.46

3,551,000 $ 8.19–18.46 $13.74 1.54 3,550,000 $13.74

The number of options exercisable at December 31, 2008 and 2007 were 3,706,000 and 3,938,000, with a

weighted average exercise price of $13.46 and $13.13, respectively.

Cash received upon the exercise of options during 2009, 2008 and 2007 was $0.8 million, $1.4 million and

$13.8 million, respectively. There is no remaining unrecognized compensation cost associated with unvested

stock options at December 31, 2009.

For purposes of determining compensation expense, the fair value of each option grant is estimated on the

date of grant using the Black-Scholes option-pricing model which requires the use of various assumptions

including expected life of the option, expected dividend rate, expected volatility, and risk-free interest rate. The

expected life (estimated period of time outstanding) of stock options granted was estimated using the historical

F-23

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements