Frontier Communications 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

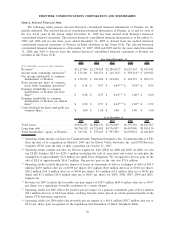

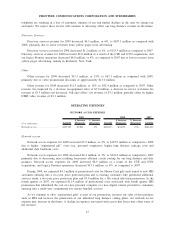

Future Commitments

A summary of our future contractual obligations and commercial commitments as of December 31, 2009

is as follows:

Contractual Obligations:

($ in thousands) Total 2010 2011-2012 2013-2014 Thereafter

Payment due by period

Long-term debt obligations, excluding

interest................................ $4,884,151 $ 7,236 $ 460,322 $1,310,372 $3,106,221

Interest on long-term debt ................ 4,593,546 362,308 703,055 592,803 2,935,380

Operating lease obligations ............... 64,288 24,417 20,034 12,903 6,934

Purchase obligations ..................... 30,269 11,026 10,828 8,250 165

Liability for uncertain tax positions ....... 56,860 3,454 45,538 7,587 281

Total ............................... $9,629,114 $408,441 $1,239,777 $1,931,915 $6,048,981

At December 31, 2009, we have outstanding performance letters of credit totaling $27.7 million.

Divestitures

On August 24, 1999, our Board of Directors approved a plan to divest our public utilities services

businesses, which included gas, electric and water and wastewater businesses. We have sold all of these

properties. In 2006, we disposed of ELI, our former CLEC business. All of the agreements relating to the sales

provide that we will indemnify the buyer against certain liabilities (typically liabilities relating to events that

occurred prior to sale), including environmental liabilities, for claims made by specified dates and that exceed

threshold amounts specified in each agreement (see Note 21).

Critical Accounting Policies and Estimates

We review all significant estimates affecting our consolidated financial statements on a recurring basis and

record the effect of any necessary adjustment prior to their publication. Uncertainties with respect to such

estimates and assumptions are inherent in the preparation of financial statements; accordingly, it is possible that

actual results could differ from those estimates and changes to estimates could occur in the near term. The

preparation of our financial statements in conformity with U.S. GAAP requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements,

the disclosure of contingent assets and liabilities, and the reported amounts of revenue and expenses during the

reporting period. Estimates and judgments are used when accounting for allowance for doubtful accounts,

impairment of long-lived assets, intangible assets, depreciation and amortization, pension and other

postretirement benefits, income taxes, contingencies and purchase price allocations, among others.

Management has discussed the development and selection of these critical accounting estimates with the

Audit Committee of our Board of Directors and our Audit Committee has reviewed our disclosures relating to

such estimates.

Allowance for Doubtful Accounts

We maintain an allowance for estimated bad debts based on our estimate of collectability of our accounts

receivable through a review of aging categories and specific customer accounts. In 2009 and 2008, we had no

“critical estimates” related to telecommunications bankruptcies.

Asset Impairment

In 2009 and 2008, we had no “critical estimates” related to asset impairments.

39

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES