Frontier Communications 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

telephony are resulting in a loss of customers, minutes of use and further declines in the rates we charge our

customers. We expect these factors will continue to adversely affect our long distance revenue in the future.

Directory Services

Directory services revenue for 2009 decreased $6.3 million, or 6%, to $107.1 million as compared with

2008, primarily due to lower revenues from yellow pages local advertising.

Directory services revenue for 2008 decreased $1.2 million, or 1%, to $113.3 million as compared to 2007.

Directory services revenue for 2008 increased $2.8 million as a result of the CTE and GVN acquisitions, and

our legacy Frontier operations decreased $4.0 million, or 4%, as compared to 2007 due to lower revenues from

yellow pages advertising, mainly in Rochester, New York.

Other

Other revenue for 2009 decreased $15.3 million, or 19%, to $67.1 million as compared with 2008,

primarily due to video promotional discounts of approximately $13.6 million.

Other revenue for 2008 decreased $11.5 million, or 12%, to $82.4 million as compared to 2007. Other

revenue was impacted by a decrease in equipment sales of $7.0 million, a decrease in service activation fee

revenue of $3.3 million and decreased “bill and collect” fee revenue of $3.2 million, partially offset by higher

DISH video revenue of $3.3 million.

OPERATING EXPENSES

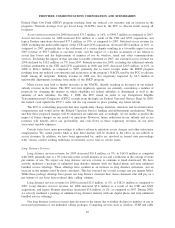

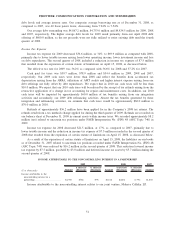

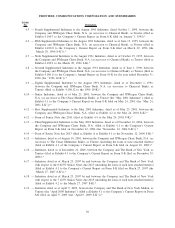

NETWORK ACCESS EXPENSES

($ in thousands) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

$ Increase

(Decrease)

% Increase

(Decrease) Amount

2009 2008 2007

Network access . . . ................... $225,907 $3,894 2% $222,013 $(6,229) (3%) $228,242

Network access

Network access expenses for 2009 increased $3.9 million, or 2%, to $225.9 million as compared to 2008

due to higher “aspirational gift” costs (e.g., personal computers), higher long distance carriage costs and

additional data backbone costs.

Network access expenses for 2008 decreased $6.2 million, or 3%, to $222.0 million as compared to 2007

primarily due to decreasing rates resulting from more efficient circuit routing for our long distance and data

products. Network access expenses for 2008 increased $8.9 million as a result of the CTE and GVN

acquisitions, and legacy Frontier operations decreased $15.1 million, or 8%, as compared to 2007.

During 2008, we expensed $4.2 million of promotional costs for Master Card gift cards issued to new HSI

customers entering into a two-year price protection plan and to existing customers who purchased additional

services under a two-year price protection plan and $3.0 million for a flat screen television promotion. In the

fourth quarter of 2007, we expensed $11.4 million of promotional costs associated with fourth quarter HSI

promotions that subsidized the cost of a new personal computer or a new digital camera provided to customers

entering into a multi-year commitment for certain bundled services.

As we continue to offer “aspirational gifts” as part of our promotions, increase our sales of data products

such as HSI and increase the penetration of our unlimited long distance calling plans, our network access

expense may increase in the future. A decline in expenses associated with access line losses may offset some of

the increase.

47

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES