Frontier Communications 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On May 13, 2009, we entered into a definitive agreement with Verizon under which Frontier will acquire

defined assets and liabilities of the local exchange business and related landline activities of Verizon in the

Spinco territory, including Internet access and long distance services and broadband video provided to

designated customers in the Spinco territory. Assuming that the merger occurred on December 31, 2009, the

merger would have resulted in Frontier acquiring approximately 4.2 million access lines and certain business

related assets from Verizon. The Verizon Transaction will be financed with approximately $5.3 billion of

common stock plus the assumption of approximately $3.33 billion in debt. Certain of the conditions to the

closing of the Verizon Transaction have already been met: (1) Frontier’s shareholders approved the Verizon

Transaction at a special meeting of shareholders held on October 27, 2009; (2) the Federal Trade Commission

has granted early termination of the waiting period under the Hart-Scott-Rodino Act; (3) approvals of all

necessary local video franchise authorities (subject to the satisfaction of certain conditions); (4) receipt by

Verizon of a favorable ruling from the IRS regarding the tax consequences of the Verizon Transaction; and

(5) five of the nine required state regulatory approvals. Completion of the Verizon Transaction remains subject

to a number of other conditions, including the receipt of the remaining four state regulatory approvals, approval

from the FCC, the completion of financing on terms that satisfy certain conditions as well as other customary

closing conditions. Subject to satisfaction of these conditions, we anticipate closing this transaction during the

second quarter of 2010.

During 2007, we completed the acquisitions of Commonwealth Telephone Enterprises, Inc. (Common-

wealth or CTE), and Global Valley Networks, Inc. and GVN Services (together GVN) which expanded our

presence in Pennsylvania and California, and strengthened our position as a leading full-service

communications provider to rural markets.

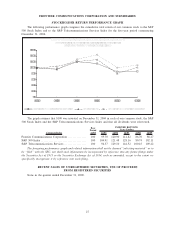

Our revenues declined in 2009. Revenues from data and internet services such as HSI grew and increased

as a percentage of our total revenues and revenues from local access lines and access charges (including federal

and state subsidies) declined and decreased as a percentage of our total revenues.

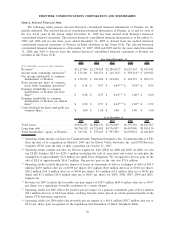

Regulatory revenue includes switched access and subsidy revenue and represents 17% of our revenues in

2009. Switched access revenue was $246.3 million in 2009, or 12% of our revenues, down from $284.9 million

in 2008, or 13% of our revenues. Federal and state subsidy revenue, including surcharges billed to customers

that are remitted to the FCC, was $113.3 million in 2009, or 5% of our revenues, down from $119.8 million in

2008, or 5% of our revenues. We expect these revenue trends in switched access and subsidy revenue to

continue in 2010.

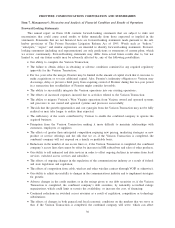

Competition in the communications industry is intense and increasing. We experience competition from

many communications service providers. These providers include cable operators offering video, data, and

VOIP products, wireless carriers, long distance providers, competitive local exchange carriers, Internet

providers and other wireline carriers. We believe that as of December 31, 2009, approximately 73% of the

households in our territories had VOIP as an available service option. We also believe that competition will

continue in 2010 and may result in reduced revenues.

The lingering impact of the severe contraction in the global financial markets that occurred in 2008 and

2009 and the subsequent recession has impacted residential and business customer behavior to reduce

expenditures by not purchasing our services or by discontinuing some or all of our services. These trends may

continue and may result in a continued challenging revenue environment. These factors could also result in

increased delinquencies and bankruptcies and, therefore, affect our ability to collect money owed to us by

residential and business customers.

We employ a number of strategies to combat the competitive pressures and changes in consumer behavior

noted above. Our strategies are focused on preserving and generating new revenues through customer retention,

upgrading and up-selling services to our existing customer base, new customer growth, win backs of former

customers, new product deployment, and upon managing our profitability and cash flow through targeted

reductions in operating expenses and capital expenditures.

We seek to achieve our customer retention goals by offering attractive packages of value-added services to

our access line customers and providing exemplary customer service. Bundled services include HSI, unlimited

long distance calling, enhanced telephone features and video offerings. We tailor these services to the needs of

our residential and business customers and continually evaluate the introduction of new and complementary

32

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES