Frontier Communications 2009 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

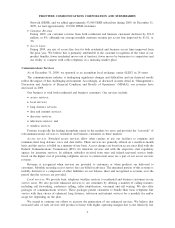

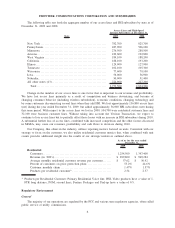

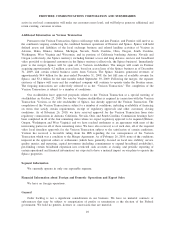

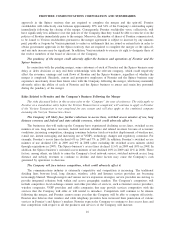

The following table sets forth the aggregate number of our access lines and HSI subscribers by state as of

December 31, 2009 and 2008.

State 2009 2008

Access Lines and High-Speed

Internet Subscribers at December 31,

New York .................................................... 782,700 825,700

Pennsylvania .................................................. 487,900 506,100

Minnesota. .................................................... 276,500 280,500

Arizona . ...................................................... 189,600 192,800

West Virginia ................................................. 189,100 188,200

California ..................................................... 188,100 193,200

Illinois. . ...................................................... 129,000 127,900

Tennessee..................................................... 102,100 105,300

Wisconsin. .................................................... 77,600 79,100

Iowa.......................................................... 56,000 56,900

Nebraska...................................................... 50,000 51,400

All other states (13) ........................................... 224,900 227,200

Total . ...................................................... 2,753,500 2,834,300

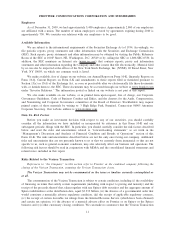

Change in the number of our access lines is one factor that is important to our revenue and profitability.

We have lost access lines primarily as a result of competition and business downsizing, and because of

changing consumer behavior (including wireless substitution), economic conditions, changing technology and

by some customers disconnecting second lines when they add HSI. We lost approximately 136,800 access lines

(net) during the year ended December 31, 2009, but added approximately 56,000 HSI subscribers (net) during

this same period. With respect to the access lines we lost in 2009, 104,700 were residential customer lines and

32,100 were business customer lines. Without taking into account the Verizon Transaction, we expect to

continue to lose access lines but to partially offset those losses with an increase in HSI subscribers during 2010.

A substantial further loss of access lines, combined with increased competition and the other factors discussed

in MD&A, may cause our revenues, profitability and cash flows to decrease during 2010.

Our Company, like others in the industry, utilizes reporting metrics focused on units. Consistent with our

strategy to focus on the customer, we also utilize residential customer metrics that, when combined with unit

counts provides additional insight into the results of our strategic initiatives outlined above.

2009 2008

As of or for the year ended

December 31,

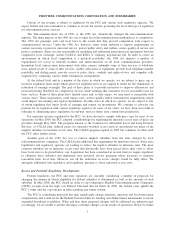

Residential:

Customers . . .................................................... 1,254,500 1,347,400

Revenue (in ‘000’s) . . . .......................................... $ 899,800 $ 949,284

Average monthly residential customer revenue per customer. ...... $ 57.62 $ 56.42

Percent of customers on price protection plans ................... 53.2% 44.6%

Customer monthly churn ........................................ 1.47% 1.57%

Products per residential customer* ............................... 2.54 2.37

* Products per Residential Customer: Primary Residential Voice line, HSI, Video products have a value of 1.

FTR long distance, POM, second lines, Feature Packages and Dial-up have a value of 0.5.

Regulatory Environment

General

The majority of our operations are regulated by the FCC and various state regulatory agencies, often called

public service or utility commissions.

6

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES