Frontier Communications 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

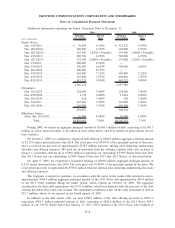

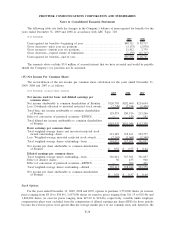

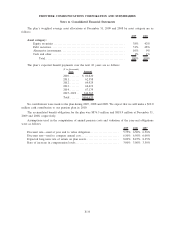

The provision (benefit) for Federal and state income taxes, as well as the taxes charged or credited to

shareholders’ equity of Frontier, includes amounts both payable currently and deferred for payment in future

periods as indicated below:

($ in thousands) 2009 2008 2007

Income taxes charged to the consolidated statement of

operations:

Current:

Federal .............................................. $11,618 $ 68,114 $ 37,815

State . ............................................... (2,630) 4,415 9,188

Total current .................................... 8,988 72,529 47,003

Deferred:

Federal .............................................. 49,916 32,984 75,495

State . ............................................... 11,024 983 5,516

Total deferred ................................... 60,940 33,967 81,011

Total income taxes charged to the consolidated statement of

operations (a) ............................................... 69,928 106,496 128,014

Income taxes charged (credited) to shareholders’ equity of

Frontier:

Deferred income tax benefits on unrealized/realized gains

or losses on securities classified as available-for-sale ..... — — (11)

Current benefit arising from stock options exercised and

restricted stock ......................................... 881 (4,877) (552)

Deferred income taxes (benefits) arising from the recognition of

additional pension/OPEB liability ............................ (4,353) (88,410) (6,880)

Total income taxes charged (credited) to shareholders’ equity of

Frontier (b) . . ............................................... (3,472) (93,287) (7,443)

Total income taxes: (a) plus (b)................................ $66,456 $ 13,209 $120,571

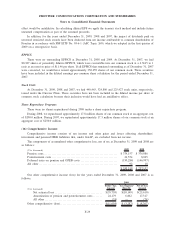

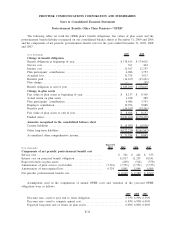

During 2009, we retrospectively changed our method of accounting for repairs and maintenance costs for

tax return purposes. The effect of this change was a decrease of our current tax expense and an offsetting

increase of our deferred tax expense of approximately $35.8 million in our 2009 income tax provision.

Additionally, in part due to the above noted accounting change, refunds of approximately $56.2 million have

been applied for in the Company’s 2008 tax returns. Refunds are recorded on our balance sheet at

December 31, 2009 in current assets within income taxes. We recorded approximately $8.2 million (net) related

to uncertain tax positions under FASB Interpretation No. (FIN) 48 (ASC Topic 740) in 2009.

ASC Topic 740 (formerly FASB Interpretation No. (FIN) 48, “Accounting for Uncertainty in Income

Taxes”) requires applying a “more likely than not” threshold to the recognition and derecognition of uncertain

tax positions either taken or expected to be taken in the Company’s income tax returns. The total amount of our

gross tax liability for tax positions that may not be sustained under a “more likely than not” threshold amounts

to $61.9 million as of December 31, 2009 including interest of $5.0 million. The amount of our total tax

liabilities reflected above that would positively impact the calculation of our effective income tax rate, if our

tax positions are sustained, is $29.3 million as of December 31, 2009.

The Company’s policy regarding the classification of interest and penalties is to include these amounts as

a component of income tax expense. This treatment of interest and penalties is consistent with prior periods.

We have recognized in our consolidated statement of operations for the year ended December 31, 2009,

additional interest in the amount of $1.4 million. We are subject to income tax examinations generally for the

years 2006 forward for Federal and 2005 for state filing jurisdictions. We also maintain uncertain tax positions

in various state jurisdictions. Amounts related to uncertain tax positions that may change within the next twelve

months are not material.

F-27

FRONTIER COMMUNICATIONS CORPORATION AND SUBSIDIARIES

Notes to Consolidated Financial Statements