DIRECTV 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

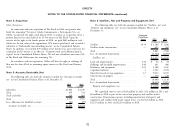

Senior Notes fair values based on quoted market prices of our senior notes, which is a Level 1

input under the accounting guidance for fair value measurements of assets and

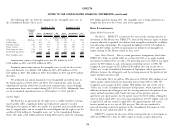

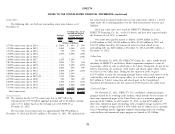

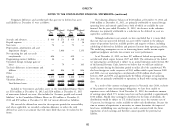

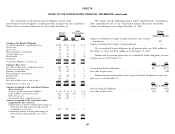

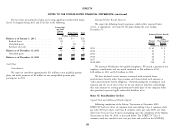

The following table sets forth our outstanding senior notes balance as of liabilities.

December 31:

All of our senior notes were issued by DIRECTV Holdings LLC and

Carrying value, net of DIRECTV Financing Co., Inc., or the Co-Issuers, and have been registered under

unamortized original

Principal issue discounts or the Securities Act of 1933, as amended.

amount including premiums

Our senior notes payable mature as follows: $1,000 million in 2014,

2012 2012 2011

$1,200 million in 2015, $2,250 million in 2016, $1,250 million in 2017 and

(Dollars in Millions)

$11,519 million thereafter. The amount of interest accrued related to our

4.750% senior notes due in 2014 ........... $ 1,000 $ 999 $ 999

outstanding debt was $246 million at December 31, 2012 and $201 million at

3.550% senior notes due in 2015 ........... 1,200 1,200 1,199

December 31, 2011.

3.125% senior notes due in 2016 ........... 750 750 750

3.500% senior notes due in 2016 ........... 1,500 1,498 1,498

Collar Loan

7.625% senior notes due in 2016 ........... — — 1,500

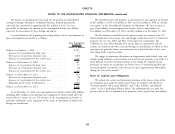

2.400% senior notes due in 2017 ........... 1,250 1,249 — On November 19, 2009, The DIRECTV Group, Inc., now a wholly owned

5.875% senior notes due in 2019 ........... 1,000 995 994 subsidiary of DIRECTV, and Liberty Media Corporation completed a series of

5.200% senior notes due in 2020 ........... 1,300 1,298 1,298 transactions, which we refer to collectively as the Liberty Transaction. As part of the

4.600% senior notes due in 2021 ........... 1,000 999 999 Liberty Transaction, we assumed a credit facility and related equity collars, which

5.000% senior notes due in 2021 ........... 1,500 1,495 1,494 we refer to as the Collar Loan. During the first quarter of 2010, we paid

3.800% senior notes due in 2022 ........... 1,500 1,499 — $1,537 million to repay the remaining principal balance and accrued interest on the

4.375% senior notes due in 2029 (1) ......... 1,219 1,206 — credit facility, and to settle the equity collars. As a result, we recorded a gain of

6.350% senior notes due in 2040 ........... 500 500 499 $67 million in ‘‘Liberty transaction and related gain’’ in the Consolidated

6.000% senior notes due in 2040 ........... 1,250 1,234 1,234 Statements of Operations in the first quarter of 2010 related to the Collar Loan.

6.375% senior notes due in 2041 ........... 1,000 1,000 1,000

5.150% senior notes due in 2042 ........... 1,250 1,248 — Commercial Paper

Total senior notes .................... $17,219 $17,170 $13,464 On November 27, 2012, DIRECTV U.S. established a commercial paper

program backed by its revolving credit facilities, which provides for the issuance of

(1) The amounts for the 4.375% senior notes due in 2029 reflect the short-term commercial paper in the United States up to a maximum aggregate

remeasurement of £750 million aggregate principal and £742 million carrying principal of $2.5 billion. As of December 31, 2012, we had $358 million of

value to U.S. dollars based on the exchange rate of £1.00/$1.63 at short-term commercial paper outstanding, with a weighted average maturity of 90

December 31, 2012. days, at a weighted average yield of 0.54%, which may be refinanced on a periodic

basis as borrowings mature. Aggregate amounts outstanding under the revolving

The fair value of our senior notes was approximately $18,598 million at credit facilities and commercial paper program are limited to $2.5 billion.

December 31, 2012 and $14,512 million at December 31, 2011. We calculated the

78