DIRECTV 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

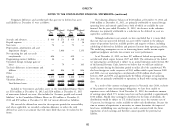

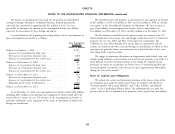

Consolidated Balance Sheets. These amounts secure our letter of credit obligations Sheets and reclassified to earnings in the same periods during which the hedged

and restrictions on the cash will be removed as the letters of credit expire. debt affects earnings. The ineffective portion of the unrealized gains and losses on

these cross-currency swaps, if any, is recorded immediately in earnings. During the

Note 11: Derivative Financial Instruments year ended December 31, 2012, DIRECTV U.S. reclassified $11 million

($7 million after tax) from ‘‘Accumulated other comprehensive loss’’ in the

Cross-Currency Swaps Consolidated Balance Sheets, into ‘‘Other, net’’ in the Consolidated Statements of

In connection with the issuance of the £750 million of 4.375% senior notes Operations, to offset $11 million of remeasurement loss on the British pound

due in 2029 discussed in Note 10, DIRECTV U.S. entered into cross-currency sterling denominated debt. We evaluate the effectiveness of our cross-currency swaps

swap agreements to manage the related foreign exchange risk by effectively on a quarterly basis. We measured no ineffectiveness for the year ended

converting all of the fixed-rate British pound sterling denominated debt, including December 31, 2012.

annual interest payments and the payment of principal at maturity, to fixed-rate Collateral Arrangements. We have agreements with our cross-currency swap

U.S. dollar denominated debt. These cross-currency swaps are designated and counterparties that include collateral provisions which require a party with an

qualify as cash flow hedges. The terms of the cross-currency swap agreements unrealized loss position in excess of certain thresholds to post cash collateral for the

correspond to the related hedged senior notes and the cross-currency swaps have amount in excess of the threshold. The threshold levels in our collateral agreements

maturities extending through September 2029. are based on each party’s credit ratings. As of December 31, 2012, neither we nor

We record unrealized gains on cross-currency swaps at fair value as assets and any of our counterparties were required to post collateral under the terms of the

unrealized losses on cross-currency swaps at fair value as liabilities. As of cross-currency swap agreements. We do not offset the fair value of collateral,

December 31, 2012, we recorded the fair value of unrealized losses on cross- whether the right to reclaim cash collateral (a receivable) or the obligation to return

currency swaps in the amount of $17 million in ‘‘Other liabilities and deferred cash collateral (a payable), against the fair value of the derivative instruments.

credits’’ in the Consolidated Balance Sheets. We calculated the fair value of the

cross-currency swap contracts using an income-approach model (discounted cash Note 12: Income Taxes

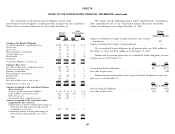

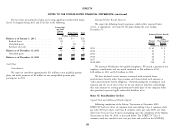

flow analysis), the use of which is considered a Level 2 valuation technique, using We base our income tax expense or benefit on reported ‘‘Income before

observable inputs, such as foreign currency exchange rates, swap rates, cross- income taxes.’’ Deferred income tax assets and liabilities reflect the impact of

currency basis swap spreads and incorporating counterparty credit risk. These cross- temporary differences between the amounts of assets and liabilities recognized for

currency swaps have been designated as cash flow hedges, and accordingly, the financial reporting purposes and such amounts recognized for tax purposes, as

effective portion of the unrealized gains and losses on the cross-currency swaps is measured by applying currently enacted tax laws.

reported in ‘‘Accumulated other comprehensive loss’’ in the Consolidated Balance

80