DIRECTV 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

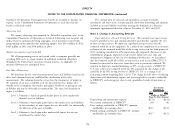

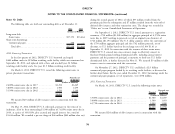

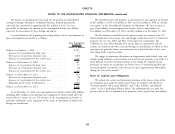

The following table sets forth the components for ‘‘Intangible assets, net’’ in $87 million payment during 2011. The intangible asset is being amortized on a

the Consolidated Balance Sheets as of: straight line basis over the 15-year term of the agreement.

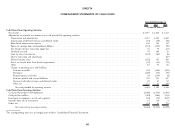

December 31, 2012 December 31, 2011 Note 8: Investments

Estimated

Useful Equity Method Investments

Lives Gross Accumulated Net Gross Accumulated Net

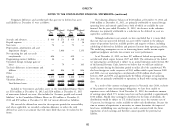

(years) Amount Amortization Amount Amount Amortization Amount Sky Mexico. DIRECTV accounts for the excess of the carrying value for its

(Dollars in Millions) investment in Sky Mexico over DIRECTV’s share of Sky Mexico’s equity in memo

Orbital slots ........ Indefinite $ 432 $ — $432 $ 432 $ — $432

Satellite rights ....... 15 101 19 82 110 12 98 accounts allocated to goodwill and definite lived intangibles attributable to affiliate

Subscriber related ..... 5-10 383 371 12 402 353 49 and advertising relationships. We recognized $4 million in 2012, $25 million in

Dealer network ....... 15 130 117 13 130 108 22 2011 and $25 million in 2010 of amortization on definite lived intangibles in

Trade name and other . . . 5-20 174 46 128 159 37 122 equity earnings of Sky Mexico related to these assets.

Distribution agreements . . 6-20 208 43 165 208 22 186

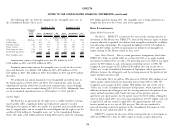

Total intangible assets . . . $1,428 $596 $832 $1,441 $532 $909 Game Show Network. Due to certain governance arrangements which limit

DIRECTV’s ability to control GSN, we account for GSN as an equity method

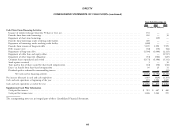

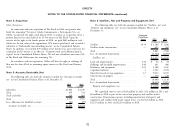

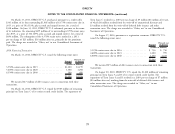

Amortization expense of intangible assets was $95 million in 2012, investment. In March 2011, we sold a 5% ownership interest in GSN to our equity

$136 million in 2011 and $190 million in 2010. partner for $60 million in cash, reducing our ownership interest to 60%. We

recognized a pre-tax gain of $25 million ($16 million after tax) on the sale in

Estimated amortization expense for intangible assets in each of the next five ‘‘Other, net’’ in the Consolidated Statements of Operations, which represents the

years and thereafter is as follows: $58 million in 2013, $50 million in 2014, difference between the selling price and the carrying amount of the portion of our

$45 million in 2015, $24 million in 2016, $24 million in 2017 and $199 million equity method investment sold.

thereafter.

In December 2012, we sold an 18% interest in GSN for $234 million to our

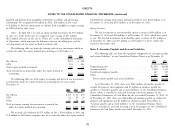

We performed our annual impairment tests for goodwill and orbital slots in equity partner, which reduced our ownership interest from 60% to 42%. We

the fourth quarters of 2012, 2011 and 2010. The estimated fair values for each recognized a pre-tax gain of $111 million ($68 million after tax) on the sale in

reporting unit and the orbital slots exceeded our carrying values, and accordingly, ‘‘Other, net’’ in the Consolidated Statement of Operations, which represents the

no impairment losses were recorded during 2012, 2011 or 2010. Additionally, there difference between the selling price and the carrying amount of the portion of our

are no accumulated impairment losses as of December 31, 2012 and 2011. equity method investment sold. Under the terms of the purchase and sale

agreement, our equity partner has the option to pay the $234 million selling price

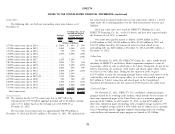

Satellite Rights either in full in April 2013, or in two equal installments of $117 million each: one

Sky Brasil has an agreement for the right to use a satellite should its existing in April 2013 and the second in April 2014. All unpaid amounts will accrue

leased satellite suffer a significant failure and replacement capacity is needed. interest payable to us at a rate of 10% per year. This sale was considered a

During the first quarter of 2010, the satellite was launched and successfully placed non-cash investing activity for purposes of the Consolidated Statements of Cash

into its assigned orbit, and we recorded the total obligation for the right to use the Flows for the year ended December 31, 2012.

satellite of $116 million in ‘‘Intangible assets, net’’ in the Consolidated Balance DIRECTV accounts for the excess of the carrying value for its investment in

Sheets. We made a $29 million payment during 2010 and we made the remaining GSN over DIRECTV’s share of GSN’s equity in memo accounts allocated to

74