DIRECTV 2012 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

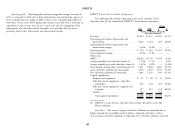

Acquisition notes, resulting in a pre-tax charge of $25 million ($16 million after tax) primarily

for the premiums paid. The charge was recorded in ‘‘Other, net’’ in our

Globo Transaction Consolidated Statements of Operations.

In connection with our acquisition of Sky Brasil in 2006, Globo was granted

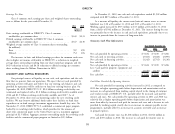

the right, until January 2014, to require us to purchase all or a portion (but not 2010 Financing Transactions

less than half) of its 25.9% interest in Sky Brasil. Upon the exercise of this right in In 2010, DIRECTV U.S. issued $6.0 billion of senior notes resulting in

the fourth quarter of 2010, we paid $605 million in cash, which was the fair value $5,978 million of proceeds, net of discount. Also in 2010, DIRECTV U.S. repaid

of the 19% interest purchased, and recorded a reduction to ‘‘Redeemable the $2,205 million of remaining principal on the Term Loans of its senior secured

noncontrolling interest’’ in the Consolidated Balance Sheets. We and our credit facility, resulting in a pre-tax charge of $16 million ($10 million after tax) for

subsidiaries now own approximately 93% of Sky Brasil and Globo retains the right the write-off of deferred debt issuance and other transaction costs. The charge was

to sell its remaining 7% interest to us at fair value until January 2014 as discussed recorded in ‘‘Other, net’’ in our Consolidated Statements of Operations.

in Note 21 of the Notes to the Consolidated Financial Statements in Item 8,

Part II of this Annual Report. Collar Loan. As part of the Liberty Transaction in November 2009, we

assumed a credit facility and related equity collars, which we refer to as the Collar

Financing Transactions Loan. During the first quarter of 2010, we paid $1,537 million to repay the

remaining principal balance and accrued interest on the credit facility, and to settle

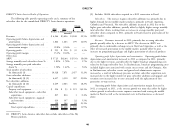

2012 Financing Transactions the equity collars. As a result, we recorded a gain of $67 million in ‘‘Liberty

In the first quarter of 2012, DIRECTV U.S. borrowed and repaid transaction and related gain’’ in the Consolidated Statements of Operations in the

$400 million under its $2.0 billion revolving credit facility, which was terminated first quarter of 2010 related to the Collar Loan.

on September 28, 2012, and replaced with a three and one-half year, $1.0 billion

revolving credit facility and a five year, $1.5 billion revolving credit facility. In Venezuela Devaluation and Foreign Currency Exchange Controls

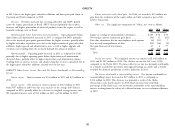

November 2012, DIRECTV U.S. established a commercial paper program backed In January 2010, the Venezuelan government announced the creation of a dual

by its revolving credit facilities, which provides for the issuance of short-term exchange rate system, including an exchange rate of 4.3 bolivars per U.S. dollar for

commercial paper in the United States up to a maximum aggregate principal of most of the activities of our Venezuelan operations compared to an exchange rate of

$2.5 billion. For the year ended December 31, 2012, borrowings under the 2.15 Venezuelan bolivars prior to the announcement. As a result of this devaluation,

commercial paper program, net of repayments, were $358 million. we recorded a $6 million charge to net income in the year ended December 31,

In 2012, DIRECTV U.S. issued $5.2 billion of senior notes resulting in 2010 related to the adjustment of net bolivar denominated monetary assets to the

$5,190 million of proceeds, net of discount. Also in 2012, DIRECTV U.S. new official exchange rate.

redeemed its then outstanding $1,500 million of 7.625% senior notes, resulting in Companies operating in Venezuela are required to obtain Venezuelan

a pre-tax charge of $64 million ($40 million after tax) for the premiums paid and government approval to exchange bolivars into U.S. dollars at the official exchange

for the write-off of deferred debt issuance and other transaction costs. The charge rate and we have not been able to consistently exchange Venezuelan bolivars into

was recorded in ‘‘Other, net’’ in our Consolidated Statements of Operations. U.S. dollars at the official rate. Until the closing of the parallel market in May,

2010, we relied on a parallel exchange process to settle U.S. dollar obligations and

2011 Financing Transactions to repatriate accumulated cash balances. The rates implied by transactions in the

In 2011, DIRECTV U.S. issued $4.0 billion of senior notes resulting in parallel market, were significantly higher than the official rate (6 to 7 bolivars per

$3,990 million of proceeds, net of discount. Also in 2011, DIRECTV U.S. U.S. dollar). As a result, we recorded a $22 million charge in 2010 in ‘‘General and

purchased and redeemed its then outstanding $1,002 million of 6.375% senior administrative expenses’’ in the Consolidated Statements of Operations in

41