DIRECTV 2012 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

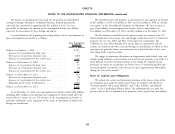

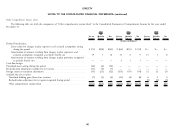

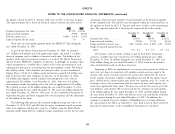

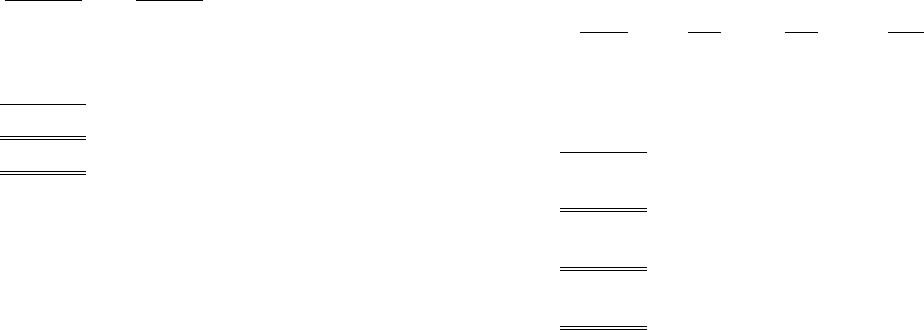

Changes in the status of outstanding restricted stock units were as follows: Changes in the status of outstanding options were as follows:

Weighted-Average Weighted-

Grant-Date Weighted- Average

Stock Units Fair Value Shares Average Remaining Aggregate

Under Exercise Contractual Intrinsic

Nonvested at January 1, 2012 ............... 7,595,892 $31.35 Option Price Term Value

Granted ............................. 2,847,076 41.72 (in years) (in millions)

Vested and distributed .................... (3,122,772) 21.78 Outstanding at January 1, 2012 3,364,510 $23.21

Forfeited ............................. (247,450) 40.38 Granted ................ 995,964 48.18

Exercised ............... (1,260,629) 30.62

Nonvested at December 31, 2012 ............ 7,072,746 $39.50 Forfeited or expired ........ (4,000) 16.23

Vested and expected to vest at December 31, 2012 . 6,819,177 $39.26 Outstanding at December 31,

2012 ................ 3,095,845 $28.24 4.6 $68

The weighted-average grant-date fair value of restricted stock units granted

during the year ended December 31, 2011 was $41.14. The weighted-average Vested and expected to vest at

grant-date fair value of restricted stock units granted during the year ended December 31, 2012 ....... 3,095,845 $28.24 4.6 $68

December 31, 2010 was $30.83. Exercisable at December 31,

The total fair value of restricted stock units vested and distributed was 2012 ................ 2,196,293 $19.93 2.5 $66

$139 million during the year ended December 31, 2012, $125 million during the

The total intrinsic value of options exercised was $26 million during the year

year ended December 31, 2011 and $81 million during the year ended

ended December 31, 2012, $24 million during the year ended December 31, 2011

December 31, 2010.

and $221 million during the year ended December 31, 2010, based on the intrinsic

value of individual awards on the date of exercise.

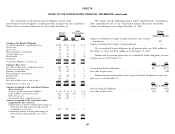

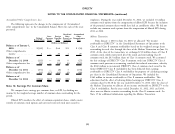

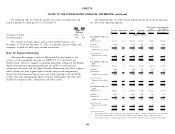

Stock Options

The following table presents the estimated weighted-average grant-date fair

The Compensation Committee has also granted stock options to acquire our

value for the stock options granted during the years ended December 31, 2012 and

common stock under our stock plan to certain of our executives. The exercise price

December 31, 2010 under the DIRECTV Plan using the Black-Scholes valuation

of options granted is equal to the per share closing price of the common stock on

model along with the weighted-average assumptions used in the fair value

the date the options were granted. These nonqualified options generally vest over

calculations. Expected stock volatility is based primarily on the historical volatility

one to three years, expire ten years from date of grant and are subject to earlier

of our common stock. The risk-free rate for periods within the contractual life of

termination under certain conditions.

93