DIRECTV 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

in 2011 due to the higher gross subscriber additions and lower post paid churn in Liberty transaction and related gain. In 2010, we recorded a $67 million net

Venezuela and Brazil compared to 2010. gain from the settlement of the equity collars and debt assumed as part of the

Liberty Transaction.

Revenues. Revenues increased due to strong subscriber and ARPU growth

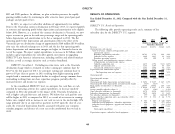

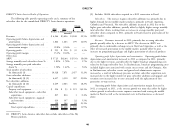

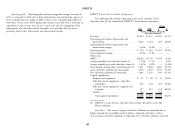

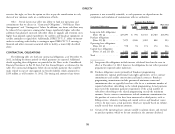

across the region, particularly in Brazil. ARPU increased primarily due to price Other, net. The significant components of ‘‘Other, net’’ were as follows:

increases and higher penetration of advanced products across the region, as well as 2011 2010 Change

favorable exchange rates in Brazil. (Dollars in Millions)

Operating profit before depreciation and amortization. Operating profit before Equity in earnings of unconsolidated subsidiaries ....... $109 $ 90 $ 19

depreciation and amortization increased in 2011 as compared to 2010, primarily Net foreign currency transaction gain (loss) ........... (50) 11 (61)

due to the increased gross profit generated from the higher revenues, partially offset Fair value adjustment loss on non-employee stock options . (4) (11) 7

by higher subscriber acquisition costs due to the higher number of gross subscriber Loss on early extinguishment of debt ............... (25) (16) (9)

additions, higher general and administrative costs as well as higher upgrade and Net gain from sale of investments ................. 63 6 57

retention costs resulting from the increased demand for advanced products. Other ................................... (9) (11) 2

Total .................................. $ 84 $69 $15

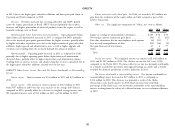

Operating profit. Operating profit increased in 2011 as compared to 2010,

primarily due to higher operating profit before depreciation and amortization, Income tax expense. We recognized income tax expense to $1,348 million in

discussed above, partially offset by higher depreciation and amortization expense 2011 and $1,202 million in 2010. The effective tax rate for 2011 was 33.8%

resulting from an increase in basic and advanced product receivers capitalized due to compared to 34.2% for 2010. The lower effective tax rate was primarily attributable

the higher gross subscriber additions attained over the last year. to a benefit recorded for previously unrecognized foreign tax credits and a benefit

recorded for domestic production activities deduction in 2011.

DIRECTV Other Income, Income Taxes and Net Income Attributable to Noncontrolling

Interest Net income attributable to noncontrolling interest. Net income attributable to

noncontrolling interest decreased to $27 million in 2011 as compared to

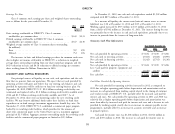

Interest income. Interest income was $34 million in 2011 and $39 million in

$114 million in 2010. This decrease was primarily a result of the Globo

2010.

Transaction in the fourth quarter of 2010 which increased our ownership

Interest expense. The increase in interest expense to $763 million in 2011 percentage in Sky Brasil and a net tax benefit attributable to the noncontrolling

from $557 million in 2010 was due to an increase in the average debt balances interest resulting from the release of a deferred income tax asset valuation allowance

compared to 2010, partially offset by a decrease in weighted average interest rates. in 2010.

We capitalized interest costs of $13 million in 2011 and $6 million in 2010.

50