DIRECTV 2012 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

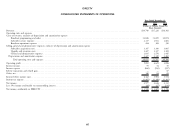

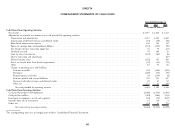

DIRECTV

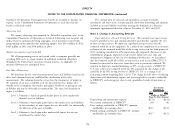

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2012 2011 2010

(Dollars in Millions)

Cash Flows From Operating Activities

Net income ........................................................................................ $2,977 $ 2,636 $ 2,312

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization .......................................................................... 2,437 2,349 2,482

Amortization of deferred revenues and deferred credits ........................................................... (75) (39) (36)

Share-based compensation expense ........................................................................ 109 103 82

Equity in earnings from unconsolidated affiliates ............................................................... (131) (109) (90)

Net foreign currency transaction (gain) loss .................................................................. 34 50 (11)

Dividends received .................................................................................. 79 104 78

Gain on sale of investments ............................................................................ (122) (63) (6)

Liberty transaction and related gain ....................................................................... — — (67)

Deferred income taxes ................................................................................ (102) 353 386

Excess tax benefit from share-based compensation .............................................................. (30) (25) (11)

Other .......................................................................................... 85 53 66

Change in operating assets and liabilities:

Accounts receivable ................................................................................ (50) (524) (391)

Inventories ..................................................................................... (206) (33) (35)

Prepaid expenses and other ........................................................................... 58 (139) (4)

Accounts payable and accrued liabilities ................................................................... 370 391 437

Unearned subscriber revenues and deferred credits ............................................................ 28 47 52

Other, net ...................................................................................... 173 31 (38)

Net cash provided by operating activities ................................................................. 5,634 5,185 5,206

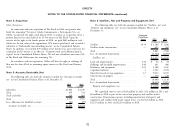

Cash Flows From Investing Activities

Cash paid for property and equipment ....................................................................... (2,960) (2,924) (2,303)

Cash paid for satellites ................................................................................. (389) (246) (113)

Investment in companies, net of cash acquired .................................................................. (16) (11) (617)

Proceeds from sale of investments .......................................................................... 24 116 9

Other, net ......................................................................................... (22) 43 (75)

Net cash used in investing activities .................................................................... (3,363) (3,022) (3,099)

The accompanying notes are an integral part of these Consolidated Financial Statements.

65