DIRECTV 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

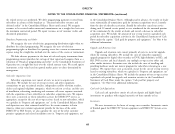

Statements of Operations. Unrecognized tax benefits are recorded in ‘‘Income tax The carrying value of cash and cash equivalents, accounts receivable,

expense’’ in the Consolidated Statements of Operations at such time that the investments and other assets, accounts payable, short-term borrowings and amounts

benefit is effectively settled. included in accrued liabilities and other meeting the definition of a financial

instrument approximated their fair values at December 31, 2012 and 2011.

Advertising Costs

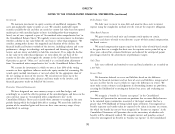

Note 3: Change in Accounting Estimate

We expense advertising costs primarily in ‘‘Subscriber acquisition costs’’ in the

Consolidated Statements of Operations as incurred. Advertising costs for print and Depreciable Lives of Leased Set-Top Receivers. We currently lease most set-top

media related to national advertising campaigns, net of payments received from receivers provided to new and existing subscribers and therefore capitalize the cost

programming content providers for marketing support, were $514 million in 2012, of those set-top receivers. We depreciate capitalized set-top receivers over the

$464 million in 2011 and $396 million in 2010. estimated useful life of the equipment. As a result of the completion of an extensive

evaluation of the estimated useful life of the set-top receivers in the third quarter of

Market Concentrations and Credit Risk 2011, including consideration of historical write-offs, improved efficiencies in our

refurbishment program, improved set-top receiver failure rates over time and

We sell programming services and extend credit, in amounts generally not management’s judgment of the risk of technological obsolescence, we determined

exceeding $200 each, to a large number of individual residential subscribers that the estimated useful life of HD set-top receivers used in our DIRECTV U.S.

throughout the United States and most of Latin America. As applicable, we business has increased to four years, from three years as previously estimated. We

maintain allowances for anticipated losses. continue to depreciate standard-definition, or SD, set-top receivers at DIRECTV

U.S. over a three-year estimated useful life. We accounted for this change in the

Fair Value Measurement useful life of the HD set-top receivers at DIRECTV U.S. as a change in an

We determine the fair value measurements of assets and liabilities based on the accounting estimate beginning July 1, 2011. This change had the effect of reducing

three level valuation hierarchy established for classification of fair value depreciation and amortization expense and increasing both net income attributable

measurements. The valuation hierarchy is based on the transparency of inputs to to DIRECTV and earnings per share in our consolidated results of operations as

the valuation of an asset or liability as of the measurement date. Inputs refer follows:

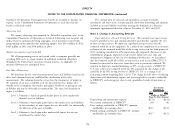

broadly to the assumptions that market participants would use in pricing an asset Years Ended

or liability and may be observable or unobservable. The three level hierarchy of December 31,

inputs is as follows: 2012 2011

(Dollars in Millions,

Level 1: Valuation is based on quoted market prices in active markets for Except Per Share Amounts)

identical assets or liabilities. Depreciation and amortization expense .............. $(176) $(141)

Level 2: Valuation is based upon quoted prices for similar assets and liabilities Net income attributable to DIRECTV .............. 109 86

in active markets, or other inputs that are observable, for substantially Basic earnings attributable to DIRECTV common

the full term of the asset or liability. stockholders per common share ................. $0.17 $0.12

Diluted earnings attributable to DIRECTV common

Level 3: Valuation is based upon other unobservable inputs that are not stockholders per common share ................. $0.17 $0.11

corroborated by market data.

71