DIRECTV 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

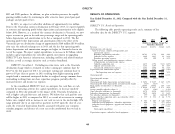

DIRECTV Guarantors. On November 14, 2011, we entered into a series of eased, accumulated cash balances may ultimately be repatriated at less than their

Supplemental Indentures whereby DIRECTV agreed to fully guarantee all of the currently reported value. As of December 31, 2012, our Venezuelan subsidiary had

senior notes then outstanding, jointly and severally with substantially all of Venezuelan bolivar denominated net monetary assets of $466 million, including

DIRECTV Holdings LLC’s domestic subsidiaries. The Supplemental Indentures cash of $563 million, based on the official 4.3 bolivars per U.S. dollar exchange

provide that DIRECTV unconditionally guarantees that the principal and interest rate at that time.

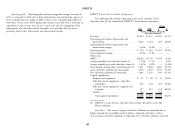

on the respective senior notes will be paid in full when due and that the obligations In February 2013, the Venezuelan government announced a devaluation of the

of the Co-Issuers to the holders of the outstanding senior notes will be performed. bolivar from the official exchange rate of 4.3 bolivars per U.S. dollar to an official

All of the senior notes issued since November 14, 2011, the revolving credit rate of 6.3 bolivars per U.S. dollar. As a result of the devaluation, we will record a

facilities and the commercial paper program are also similarly fully guaranteed by pre-tax charge in ‘‘General and administrative expenses’’ in the Consolidated

DIRECTV. Statements of Operations of approximately $160 million in the first quarter of

As a result of the guarantees, holders of the senior notes, the revolving credit 2013, related to the remeasurement of the bolivar denominated net monetary assets

debt and the commercial paper have the benefit of DIRECTV’s interests in the of our Venezuelan subsidiary as of the date of the devaluation. This devaluation did

assets and related earnings of our operations that are not held through DIRECTV not impact our results of operations, financial position or cash flows for the year

Holdings LLC and its subsidiaries. Those operations are primarily our DTH digital ended December 31, 2012, but may affect the growth of our Venezuelan business.

television services throughout Latin America which are held by DIRECTV Latin There will also be ongoing impacts to our results of operations, primarily related to

America Holdings, Inc. and its subsidiaries, and our regional sports networks which the translation of local financial statements at the new exchange rate. In the event

are held by DIRECTV Sports Networks LLC and its subsidiaries. However, the of an additional devaluation of the bolivar, we will recognize a charge to earnings

subsidiaries that own and operate the DIRECTV Latin America business and the based on the amount of bolivar denominated net monetary assets held at the time

regional sports networks have not guaranteed the senior notes, the revolving credit of such devaluation.

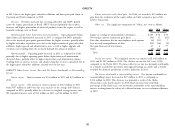

facilities and the commercial paper. Income taxes. During 2012, the statute of limitations expired in federal and

The guarantees are unsecured senior obligations of DIRECTV and rank foreign tax jurisdictions resulting in the recognition of uncertain tax benefits. As a

equally in right of payment with all of DIRECTV’s existing and future senior debt result we recorded a benefit of $168 million in ‘‘Income tax expense’’ in the

and rank senior in right of payment to all of DIRECTV’s future subordinated debt, Consolidated Statements of Operations during the year ended December 31, 2012.

if any. The guarantees are effectively subordinated to all existing and future secured During 2010, we entered into an agreement with a former owner to settle certain

obligations, if any, of DIRECTV to the extent of the value of the assets securing tax contingencies. As a result of this settlement we recorded a benefit of

the obligations. DIRECTV will not be subject to the covenants contained in each $39 million in ‘‘Income tax expense’’ in the Consolidated Statements of Operations

indenture of the senior notes and our guarantees will terminate and be released on during the year ended December 31, 2010. We engage in continuous discussions

the terms set forth in each of the indentures. and negotiations with federal, state, and foreign taxing authorities and reevaluate

our uncertain tax positions, and, while it is often difficult to predict the final

Contingencies outcome or the timing of resolution of any particular tax matter or tax position, we

believe that it is reasonably possible that our unrecognized tax benefits could

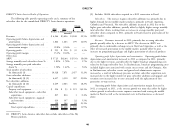

Venezuela Devaluation and Foreign Currency Exchange Controls. Companies decrease by up to approximately $40 million during the next twelve months.

operating in Venezuela are required to obtain government approval to exchange

Venezuelan bolivars into U.S. dollars at the official exchange rate. Our ability to Globo. As discussed in Note 21 of the Notes to the Consolidated Financial

pay U.S. dollar denominated obligations and repatriate cash generated in Venezuela Statements in Part II, Item 8 of this Annual Report, Globo has the right to

in excess of local operating requirements is limited, resulting in an increase in the exchange its remaining Sky Brasil shares for cash or our common shares. If Globo

cash balance at our Venezuelan subsidiary. At such time that exchange controls are

54