DIRECTV 2012 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

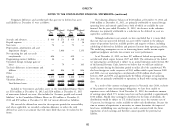

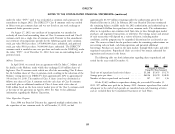

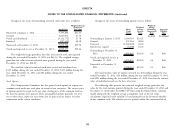

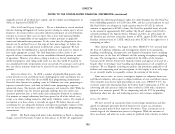

The reconciliation of the amounts used in the basic and diluted EPS Note 17: Share-Based Compensation

computation was as follows: Under the DIRECTV 2010 Stock Plan, or the DIRECTV Plan, as approved

by DIRECTV stockholders on June 3, 2010, shares, rights or options to acquire up

Per Share to 20 million shares of common stock plus the number of shares that were

Income Shares Amounts

authorized but not granted under former plans and shares granted under those

(Dollars and Shares in Millions,

Except Per Share Amounts) plans which, after June 3, 2010, are forfeited, expire or are canceled without the

Year Ended December 31, 2012: delivery of shares of common stock or otherwise result in the return of such shares

Basic EPS to us, were authorized for grant through June 2, 2020, subject to the approval of

Net income attributable to DIRECTV common stockholders . . $2,949 638 $ 4.62 the Compensation Committee of our Board of Directors. Under the DIRECTV

Effect of Dilutive Securities Plan, we issue new shares of our common stock when restricted stock units are

Dilutive effect of stock options and restricted stock units ..... — 6 (0.04)

distributed and when stock options are exercised.

Diluted EPS

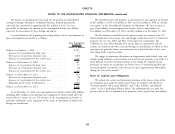

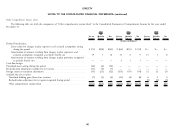

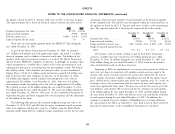

Adjusted net income attributable to DIRECTV common The following table presents amounts recorded related to share-based

stockholders ............................. $2,949 644 $ 4.58 compensation:

Year Ended December 31, 2011: For the Years Ended

Basic EPS December 31,

Net income attributable to DIRECTV common stockholders . . $2,609 747 $ 3.49 2012 2011 2010

Effect of Dilutive Securities

(Dollars in Millions)

Dilutive effect of stock options and restricted stock units ..... — 5 (0.02)

Share-based compensation expense recognized .......... $109 $103 $82

Diluted EPS Tax benefits associated with share-based compensation

Adjusted net income attributable to DIRECTV common expense .................................. 41 40 31

stockholders ............................. $2,609 752 $ 3.47

Actual tax benefits realized for the deduction of share-based

Year Ended December 31, 2010: compensation expense ........................ 60 54 60

Class A common stock:

Basic EPS As of December 31, 2012, there was $107 million of total unrecognized

Net income attributable to DIRECTV Class A common compensation expense related to unvested restricted stock units and stock options

stockholders ............................. $2,014 870 $ 2.31 that we expect to recognize as follows: $66 million in 2013, $37 million in 2014

Effect of Dilutive Securities and $4 million in 2015.

Dilutive effect of stock options and restricted stock units ..... — 6 (0.01)

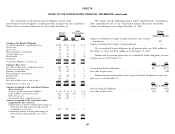

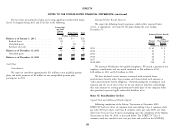

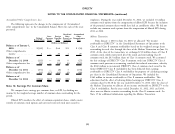

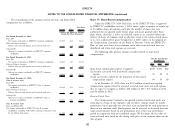

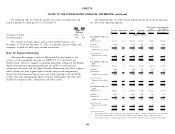

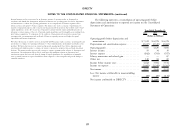

Diluted EPS Restricted Stock Units

Adjusted net income attributable to DIRECTV Class A

common stockholders ....................... $2,014 876 $ 2.30 The Compensation Committee has granted restricted stock units under our

stock plan to certain of our employees and executives. Annual awards are mostly

Class B common stock: performance based, generally vest over three years and provide for final payments in

Basic and diluted EPS

Net income attributable to DIRECTV Class B common shares of our common stock. Final payment can be increased or decreased from the

stockholders, including $160 million exchange inducement value target award amounts based on our performance over a three-year performance

for the Malone Transaction ...................... $ 184 22 $8.44 period in comparison with pre-established targets. We determine the fair value of

restricted stock units based on the closing stock price of our common shares on the

date of grant.

92