DIRECTV 2012 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

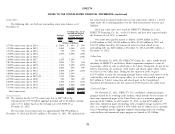

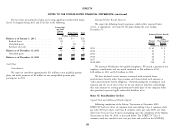

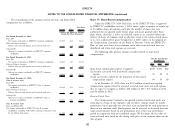

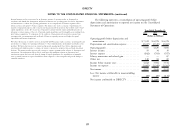

The fair value measurement of plan assets using significant unobservable inputs Estimated Future Benefit Payments

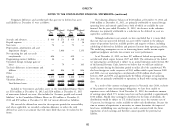

(Level 3) changed during 2011 and 2012 due to the following: We expect the following benefit payments, which reflect expected future

service, as appropriate, to be paid by the plans during the years ending

Partnerships

and Joint December 31:

Venture

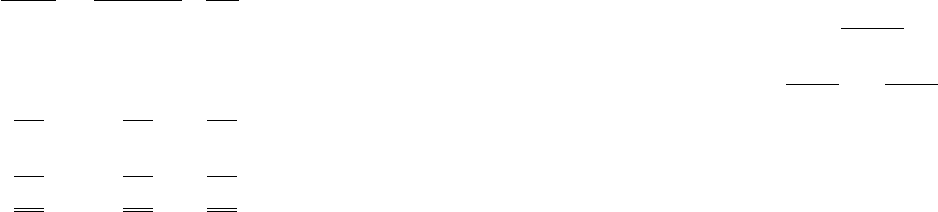

Interests Hedge Funds Total Estimated Future Benefit

(Dollars in Millions) Payments

Balance as of January 1, 2011 ............ $28 $— $28 Other

Pension Postretirement

Realized losses ...................... (1) — (1) Benefits Benefits

Unrealized gains .................... 5 (3) 2 (Dollars in Millions)

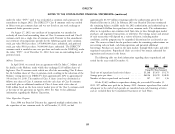

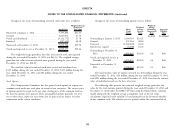

Purchases and sales ................... (2) 44 42 2013 .................................... $ 41 $ 2

Balance as of December 31, 2011 ......... 30 41 71 2014 .................................... 41 2

Unrealized gains .................... 1 3 4 2015 .................................... 42 2

2016 .................................... 42 2

Balance as of December 31, 2012 ......... $31 $44 $75

2017 .................................... 41 2

2018-2022 ................................ 218 10

Cash Flows

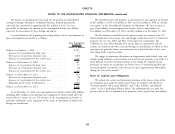

We maintain 401(k) plans for qualified employees. We match a portion of our

Contributions employee contributions and our match amounted to $30 million in 2012,

$28 million in 2011 and $23 million in 2010.

We expect to contribute approximately $15 million to our qualified pension

plans and make payments of $6 million to our nonqualified pension plan We have disclosed certain amounts associated with estimated future

participants in 2013. postretirement benefits other than pensions and characterized such amounts as

‘‘other postretirement benefit obligation.’’ Notwithstanding the recording of such

amounts and the use of these terms, we do not admit or otherwise acknowledge

that such amounts or existing postretirement benefit plans of our company (other

than pensions) represent legally enforceable liabilities of us.

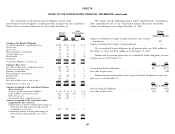

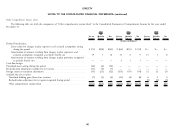

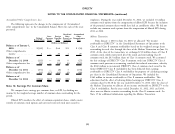

Note 15: Stockholders’ Deficit

Capital Stock and Additional Paid-In Capital

Following completion of the Liberty Transaction in November 2009,

DIRECTV had two classes of common stock outstanding: Class A common stock,

par value $0.01 per share, and Class B common stock, par value $0.01 per share.

There have been no Class B shares outstanding since the completion of the Malone

Transaction on June 16, 2010, as discussed below. The DIRECTV Class A

common stock was entitled to one vote per share and traded on the NASDAQ

88