DIRECTV 2012 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

goodwill and definite lived intangibles attributable to affiliate and advertising Undistributed earnings from equity method investments were $302 million as of

relationships. We recognized $10 million in 2012, $10 million in 2011 and December 31, 2012 and $256 million as of December 31, 2011.

$12 million in 2010 of amortization on definite lived intangibles in equity earnings

of GSN related to these assets. Equity Securities

We had investments in non-marketable equity securities of $68 million as of

Other. In April 2011, we sold an equity method investment for $55 million

December 31, 2012 and $56 million as of December 31, 2011, which were stated

in cash. As a result of this sale, we recognized a pre-tax gain of $37 million

at cost. We also had investments in marketable equity securities of $11 million as

($23 million after tax) on the sale in ‘‘Other, net’’ in the Consolidated Statements

of December 31, 2012 and $17 million as of December 31, 2011, which were

of Operations, which represents the difference between the selling price and the

carried at fair market value.

carrying amount of the equity method investment sold.

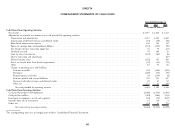

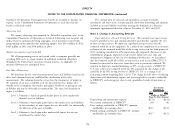

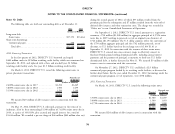

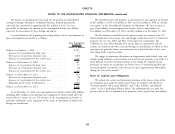

The following table sets forth the carrying value of our investments which we Note 9: Accounts Payable and Accrued Liabilities

account for under the equity method of accounting as of December 31:

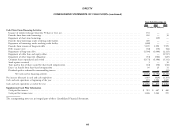

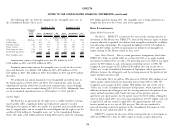

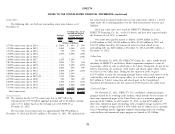

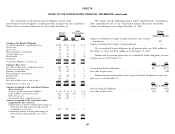

The following table sets forth the significant components of ‘‘Accounts payable

2012 2011 and accrued liabilities’’ in our Consolidated Balance Sheets as of December 31:

(Dollars in Millions)

2012 2011

Sky Mexico ................................. $510 $ 490

(Dollars in Millions)

GSN ..................................... 291 420

Programming costs ............................ $2,194 $2,006

Other equity method investments .................. 149 131

Accounts payable ............................. 1,208 1,195

Total investments accounted for under the equity method of Payroll and employee benefits ..................... 347 307

accounting ................................ $950 $1,041 Other ..................................... 869 702

Total accounts payable and accrued liabilities ......... $4,618 $4,210

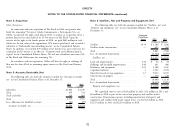

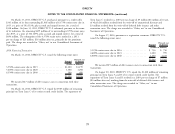

The following table sets forth equity in earnings and losses of our investments

accounted for under the equity method of accounting for the years ended

As of December 31, 2012, there were $104 million of amounts payable to

December 31:

vendors for property and equipment and $5 million of amounts payable for

2012 2011 2010 satellites in ‘‘Accounts payable and accrued liabilities’’ in the Consolidated Balance

(Dollars in Millions) Sheets, which is considered a non-cash investing activity for purposes of the

Sky Mexico ................................. $ 62 $ 52 $33 Consolidated Statements of Cash Flows for the year ended December 31, 2012. As

GSN..................................... 42 29 33 of December 31, 2011 there were $68 million of amounts payable to vendors for

Other .................................... 27 28 24 property and equipment and $3 million of amounts payable for satellites in

‘‘Accounts payable and accrued liabilities’’ in the Consolidated Balance Sheets,

Total net equity earnings for investments accounted for

which is considered a non-cash investing activity for purposes of the Consolidated

under the equity method of accounting ............. $131 $109 $90

Statements of Cash Flows for the year ended December 31, 2011.

We received cash dividends of $79 million in 2012, $104 million in 2011 and

$78 million in 2010 from companies that we account for under the equity method.

75