DIRECTV 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DIRECTV

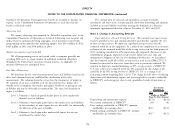

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

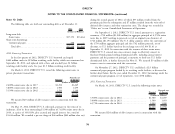

Note 10: Debt during the second quarter of 2012, of which $57 million resulted from the

premium paid for the redemption and $7 million resulted from the write-off of

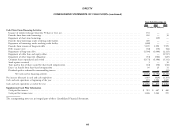

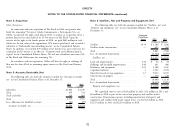

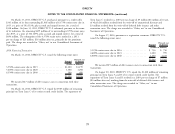

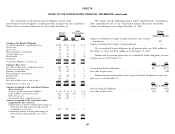

The following table sets forth our outstanding debt as of December 31: deferred debt issuance and other transaction costs. The charge was recorded in

‘‘Other, net’’ in our Consolidated Statements of Operations.

2012 2011

(Dollars in Millions) On September 11, 2012, DIRECTV U.S. issued, pursuant to a registration

Long-term debt statement, £750 million ($1,208 million) in aggregate principal of 4.375% senior

Senior notes ............................... $17,170 $13,464 notes due in 2029 resulting in proceeds, net of an original issue discount, of

Short-term borrowings £742 million ($1,194 million). The U.S. dollar amounts reflect the conversion of

Commercial paper ........................... 358 — the £750 million aggregate principal and the £742 million proceeds, net of

Total debt ............................... $17,528 $13,464 discount, to U.S. dollars based on the exchange rate of £1.00/ $1.61 at

September 11, 2012. In connection with the issuance of these senior notes,

DIRECTV U.S. entered into cross-currency swaps to effectively convert its

2012 Financing Transactions fixed-rate British pound sterling denominated debt, including annual interest

In the first quarter of 2012, DIRECTV U.S. borrowed and repaid payments and the payment of principal at maturity, to fixed-rate U.S. dollar

$400 million under its $2 billion revolving credit facility, which was terminated on denominated debt, as further discussed in Note 11. We incurred $9 million of debt

September 28, 2012, and replaced with a three and one-half year, $1 billion issuance costs in connection with this transaction.

revolving credit facility and a five year, $1.5 billion revolving credit facility. On November 27, 2012, DIRECTV U.S. established a $2.5 billion

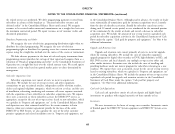

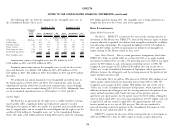

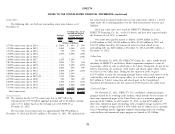

On March 8, 2012, DIRECTV U.S. issued the following senior notes in commercial paper program backed by its revolving credit facilities, as discussed in

private placement transactions: further detail below. For the year ended December 31, 2012, borrowings under the

commercial paper program, net of repayments, were $358 million.

Proceeds, net

Principal of discount 2011 Financing Transactions

(Dollars in Millions)

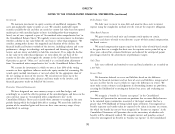

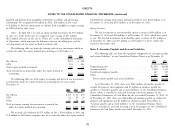

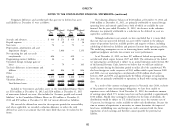

2.400% senior notes due in 2017 .......... $1,250 $1,249 On March 10, 2011, DIRECTV U.S. issued the following senior notes:

3.800% senior notes due in 2022 .......... 1,500 1,499

Proceeds, net

5.150% senior notes due in 2042 .......... 1,250 1,248 Principal of discount

$4,000 $3,996 (Dollars in Millions)

3.500% senior notes due in 2016 ................. $1,500 $1,497

We incurred $25 million of debt issuance costs in connection with this 5.000% senior notes due in 2021 ................. 1,500 1,493

transaction. 6.375% senior notes due in 2041 ................. 1,000 1,000

On May 15, 2012, DIRECTV U.S. redeemed, pursuant to the terms of its $4,000 $3,990

indenture, all of its then outstanding $1,500 million of 7.625% senior notes due in

2016, at a price of 103.813%, plus accrued and unpaid interest, for a total of We incurred $24 million of debt issuance costs in connection with this

$1,614 million. We recorded a pre-tax charge of $64 million ($40 million after tax) transaction.

76