DIRECTV 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

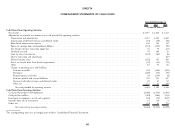

DIRECTV

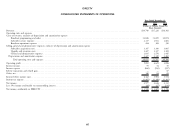

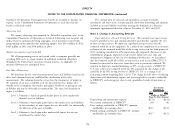

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (DEFICIT) AND REDEEMABLE NONCONTROLLING INTEREST

Accumulated

DIRECTV Common Stock Other Total Redeemable

DIRECTV Class B and Additional Accumulated Comprehensive Stockholders’ Noncontrolling Net

Common Shares Common Shares Paid-In Capital Deficit Loss Equity (Deficit) Interest Income

(Dollars in Millions, Except Share Data)

Balance as of January 1, 2010 .............................. 911,377,919 21,809,863 $6,689 $(3,722) $ (56) $ 2,911 $ 400

Net Income ......................................... 2,198 2,198 114 $2,312

Stock repurchased and retired ............................... (135,528,774) (973) (4,206) (5,179)

Stock options exercised and restricted stock units vested and distributed ....... 6,050,275 (30) (30)

Malone Transaction ..................................... 26,547,624 (21,809,863)

Share-based compensation expense ............................ 82 82

Tax benefit from share-based compensation ....................... 38 38

Dividends paid by subsidiary to redeemable noncontrolling interest ......... (15)

Acquisition of noncontrolling interest, including related deferred income taxes . . . 79 79 (605)

Adjustment to the fair value of redeemable noncontrolling interest .......... (323) (323) 323

Other ............................................. 1 1

Other comprehensive income ............................... 29 29 7

Balance as of December 31, 2010 ............................ 808,447,044 — 5,563 (5,730) (27) (194) 224

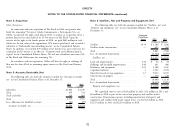

Net Income ......................................... 2,609 2,609 27 $2,636

Stock repurchased and retired ............................... (119,132,986) (825) (4,630) (5,455)

Stock options exercised and restricted stock units vested and distributed ....... 1,992,637 (48) (48)

Share-based compensation expense ............................ 103 103

Tax benefit from share-based compensation ....................... 30 30

Adjustment to the fair value of redeemable noncontrolling interest .......... (24) (24) 24

Other ............................................. 1 1

Other comprehensive loss ................................. (129) (129) (10)

Balance as of December 31, 2011 ............................ 691,306,695 — 4,799 (7,750) (156) (3,107) 265

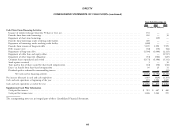

Net Income ......................................... 2,949 2,949 28 $2,977

Stock repurchased and retired ............................... (106,691,615) (739) (4,409) (5,148)

Stock options exercised and restricted stock units vested and distributed ....... 2,224,737 (54) (54)

Share-based compensation expense ............................ 109 109

Tax benefit from share-based compensation ....................... 30 30

Adjustment to the fair value of redeemable noncontrolling interest .......... (122) (122) 122

Other ............................................. (2) (2)

Other comprehensive loss ................................. (86) (86) (15)

Balance as of December 31, 2012 ............................ 586,839,817 — $4,021 $(9,210) $ (242) $(5,431) $ 400

The accompanying notes are an integral part of these Consolidated Financial Statements.

64