DIRECTV 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIRECTV

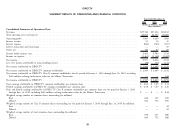

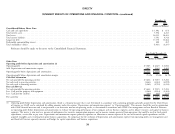

‘‘Cash paid for property and equipment’’ in the Consolidated Statements of Cash EXECUTIVE OVERVIEW AND OUTLOOK

Flows. The United States and other countries in which we operate are continuing to

undergo a period of economic uncertainty. As discussed in ‘‘Competition’’ in

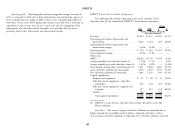

General and Administrative Expenses. General and administrative expenses

Item 1, in addition to cable and satellite system operators, we are experiencing

include departmental costs for legal, administrative services, finance, marketing and

increasing competition from telcos and other emerging digital media distribution

information technology. These costs also include expenses for bad debt and other

providers. Please refer to ‘‘Risk Factors’’ in Item 1A for a further discussion of risks

operating expenses, such as legal settlements, and gains or losses from the sale or

that may affect forecasted results of our business generally.

disposal of fixed assets.

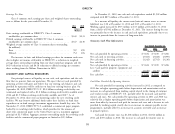

DIRECTV U.S. DIRECTV U.S. faces key challenges related to weak

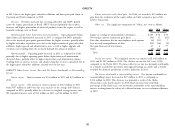

Average Monthly Revenue Per Subscriber. We calculate ARPU by dividing

macroeconomic conditions that continue to put pressure on the U.S. consumer, the

average monthly revenues for the period (total revenues during the period divided

rapid advance of technology that provides consumers with more options both in

by the number of months in the period) by average subscribers for the period. We

and out of the home and a maturing industry that is increasingly competitive. In

calculate average subscribers for the period by adding the number of subscribers as

addition, programming content providers are continuing to seek increased rates for

of the beginning of the period and for each quarter end in the current year or

their content. We are pursuing strategic priorities for the DIRECTV U.S. business

period and dividing by the sum of the number of quarters in the period plus one.

that we believe will result in consistent revenue and operating profit before

Average Monthly Subscriber Churn. Average monthly subscriber churn depreciation and amortization growth over the next three years.

represents the number of subscribers whose service is disconnected, expressed as a Our revenue growth at DIRECTV U.S. has been generated by increases in the

percentage of the average total number of subscribers. We calculate average monthly total number of subscribers and ARPU growth. In 2013, we expect revenue to

subscriber churn by dividing the average monthly number of disconnected increase in the mid-single digit percentage range driven primarily by ARPU growth,

subscribers for the period (total subscribers disconnected, net of reconnects, during which is expected to be generated mainly by price increases, higher penetration of

the period divided by the number of months in the period) by average subscribers advanced services, less discounting and continued revenue growth in DIRECTV

for the period. Cinema, commercial and advertising sales.

Subscriber Count. The total number of subscribers represents the total In 2013, we expect operating profit before depreciation and amortization to

number of subscribers actively subscribing to our service, including subscribers who grow in the mid-single digit percentage range. We intend to manage the impact to

have suspended their account for a particular season of the year because they are our margins from higher programming costs by attaining productivity

temporarily away from their primary residence and subscribers who are in the improvements from recent capital projects and by closely managing other costs

process of relocating and commercial equivalent viewing units. across the organization.

SAC. We calculate SAC, which represents total subscriber acquisition costs We expect capital expenditures in 2013 to increase to approximately $2 billion

stated on a per subscriber basis, by dividing total subscriber acquisition costs for the at DIRECTV U.S. primarily due to increased capital expenditures related to key

period by the number of gross new subscribers acquired during the period. We initiatives that are expected to enhance our DIRECTV Everywhere experience and

calculate total subscriber acquisition costs for the period by adding together to drive greater customer satisfaction and loyalty, the construction of new satellites,

‘‘Subscriber acquisition costs’’ expensed during the period and the amount of cash as well as the build out of our new El Segundo campus.

paid for equipment leased to new subscribers during the period.

DIRECTV Latin America. In Latin America, pay TV penetration and

relatively favorable macroeconomic and demographic trends continue to provide a

substantial opportunity for growth. In particular, we will continue to strengthen our

brand leadership position in the higher-end markets with a focus on our superior

43