Costco 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

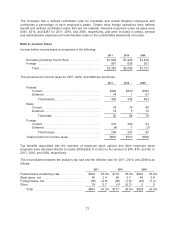

The Company has a defined contribution plan for Canadian and United Kingdom employees and

contributes a percentage of each employee’s salary. Certain other foreign operations have defined

benefit and defined contribution plans that are not material. Amounts expensed under all plans were

$345, $313, and $287 for 2011, 2010, and 2009, respectively, and were included in selling, general

and administrative expenses and merchandise costs on the consolidated statements of income.

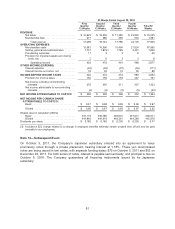

Note 9—Income Taxes

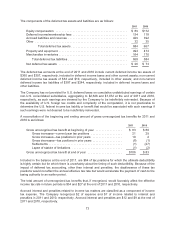

Income before income taxes is comprised of the following:

2011 2010 2009

Domestic (including Puerto Rico) ................... $1,526 $1,426 $1,426

Foreign ........................................ 857 628 301

Total ....................................... $2,383 $2,054 $1,727

The provisions for income taxes for 2011, 2010, and 2009 are as follows:

2011 2010 2009

Federal:

Current ..................................... $409 $445 $396

Deferred .................................... 74 1 67

Total federal ............................. 483 446 463

State:

Current ..................................... 78 79 66

Deferred .................................... 14 5 12

Total state .............................. 92 84 78

Foreign:

Current ..................................... 270 200 94

Deferred .................................... (4) 1 (7)

Total foreign ............................. 266 201 87

Total provision for income taxes .................... $841 $731 $628

Tax benefits associated with the exercise of employee stock options and other employee stock

programs were allocated directly to equity attributable to Costco in the amount of $59, $15, and $2, in

2011, 2010, and 2009, respectively.

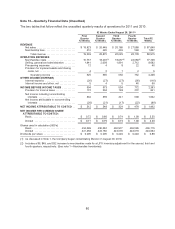

The reconciliation between the statutory tax rate and the effective rate for 2011, 2010, and 2009 is as

follows:

2011 2010 2009

Federal taxes at statutory rate .............. $834 35.0% $718 35.0% $604 35.0%

State taxes, net .......................... 55 2.4 56 2.7 48 2.8

Foreign taxes, net ........................ (66) (2.8) (38) (1.9) (24) (1.4)

Other ................................... 18 0.7 (5) (0.2) 0 0

Total ............................... $841 35.3% $731 35.6% $628 36.4%

72