Costco 2011 Annual Report Download - page 62

Download and view the complete annual report

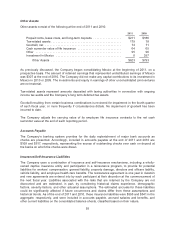

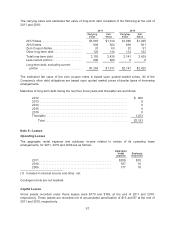

Please find page 62 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As previously discussed, Costco began consolidating Mexico at the beginning of 2011, on a

prospective basis. For 2010 and 2009, the equity in earnings of Mexico is included in interest income

and other, net in the accompanying consolidated statements of income, and was $41 and $32,

respectively.

The Company periodically evaluates unrealized losses in its investment securities for other-than-

temporary impairment using both qualitative and quantitative criteria. In the event a security is deemed

to be other-than-temporarily impaired, the Company recognizes the credit loss component in interest

income and other, net in the consolidated statements of income. The Company generally only invests

in debt securities.

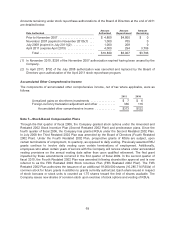

Income Taxes

The Company accounts for income taxes using the asset and liability method. Under the asset and

liability method, deferred tax assets and liabilities are recognized for the future tax consequences

attributed to differences between the financial statement carrying amounts of existing assets and

liabilities and their respective tax bases and tax credits and loss carry-forwards. Deferred tax assets

and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in

which those temporary differences and carry-forwards are expected to be recovered or settled. The

effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the

period that includes the enactment date. A valuation allowance is established when necessary to

reduce deferred tax assets to amounts expected to be realized.

The determination of the Company’s provision for income taxes requires significant judgment, the use

of estimates, and the interpretation and application of complex tax laws. Significant judgment is

required in assessing the timing and amounts of deductible and taxable items and the probability of

sustaining uncertain tax positions. The benefits of uncertain tax positions are recorded in the

Company’s consolidated financial statements only after determining a more-likely-than-not probability

that the uncertain tax positions will withstand challenge, if any, from tax authorities. When facts and

circumstances change, the Company reassesses these probabilities and records any changes in the

consolidated financial statements as appropriate. See Note 9 for additional information.

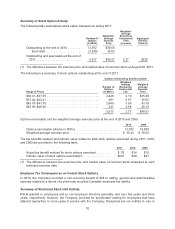

Net Income Attributable to Costco per Common Share

The computation of basic net income per share uses the weighted average number of shares that were

outstanding during the period. The computation of diluted net income per share uses the weighted

average number of shares in the basic net income per share calculation plus the number of common

shares that would be issued assuming exercise and vesting of all potentially dilutive common shares

outstanding using the treasury stock method for shares subject to stock options and restricted stock

units and the “if converted” method for the convertible note securities.

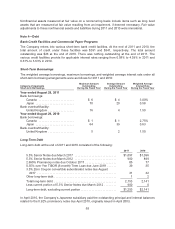

Stock Repurchase Programs

Repurchased shares of common stock are retired, in accordance with the Washington Business

Corporation Act. The par value of repurchased shares is deducted from common stock and the excess

repurchase price over par value is deducted from additional paid-in capital and retained earnings. See

Note 6 for additional information.

Recently Adopted Accounting Pronouncements

As discussed above in Note 1, the Company adopted guidance related to consolidation of variable

interest entities.

60