Costco 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

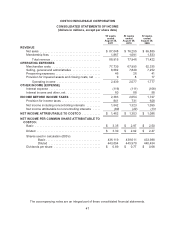

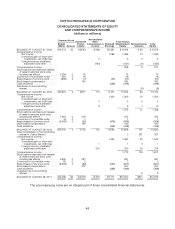

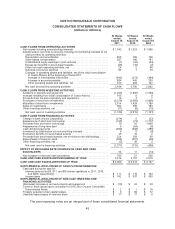

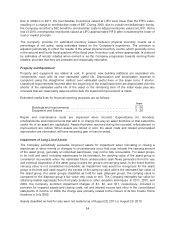

COSTCO WHOLESALE CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

52 Weeks

ended

August 28,

2011

52 Weeks

ended

August 29,

2010

52 Weeks

ended

August 30,

2009

CASH FLOWS FROM OPERATING ACTIVITIES

Net income including noncontrolling interests .......................... $1,542 $ 1,323 $ 1,099

Adjustments to reconcile net income including noncontrolling interests to net

cash provided by operating activities:

Depreciation and amortization ..................................... 855 795 728

Stock-based compensation ....................................... 207 190 181

Undistributed equity earnings in joint ventures ........................ (1) (42) (33)

Excess tax benefits on stock-based awards .......................... (45) (10) (2)

Other non-cash operating activities, net ............................. 24 2 46

Deferred income tax expense ..................................... 84 7 70

Changes in operating assets and liabilities, net of the initial consolidation

of Costco Mexico at the beginning of fiscal 2011:

Increase in merchandise inventories .............................. (642) (213) (394)

Increase in accounts payable .................................... 804 445 255

Other operating assets and liabilities, net .......................... 370 283 142

Net cash provided by operating activities ............................ 3,198 2,780 2,092

CASH FLOWS FROM INVESTING ACTIVITIES

Additions to property and equipment ................................. (1,290) (1,055) (1,250)

Increase resulting from initial consolidation of Costco Mexico ............. 165 0 0

Proceeds from the sale of property and equipment ...................... 16 4 7

Purchases of short-term investments ................................. (3,276) (2,693) (1,806)

Maturities of short-term investments .................................. 2,614 1,428 1,780

Sales of investments ............................................... 602 309 183

Other investing activities, net ........................................ (11) (8) (15)

Net cash used in investing activities ................................ (1,180) (2,015) (1,101)

CASH FLOWS FROM FINANCING ACTIVITIES

Change in bank checks outstanding .................................. (514) 5 (22)

Repayments of short-term borrowings ................................ (105) (73) (1,777)

Proceeds from short-term borrowings ................................. 79 81 1,669

Repayments of long-term debt ....................................... 0 (84) (6)

Cash dividend payments ........................................... (389) (338) (296)

Investment by (distribution to) noncontrolling interests ................... 9 0 (9)

Excess tax benefits on stock-based awards ............................ 45 10 2

Proceeds from stock-based awards, net of minimum tax withholdings ...... 224 193 69

Repurchases of common stock ...................................... (624) (551) (69)

Other financing activities, net ........................................ (2) 38 0

Net cash used in financing activities ................................ (1,277) (719) (439)

EFFECT OF EXCHANGE RATE CHANGES ON CASH AND CASH

EQUIVALENTS ................................................... 54 11 (14)

Net increase in cash and cash equivalents ............................ 795 57 538

CASH AND CASH EQUIVALENTS BEGINNING OF YEAR ................ 3,214 3,157 2,619

CASH AND CASH EQUIVALENTS END OF YEAR ...................... $4,009 $ 3,214 $ 3,157

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the year for:

Interest (reduced by $9, $11, and $8 interest capitalized in 2011, 2010,

and 2009, respectively) ......................................... $ 111 $ 110 $ 104

Income taxes ................................................... $ 742 $ 637 $ 565

SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND

FINANCING ACTIVITIES:

(Decrease) Increase in accrued property and equipment ................. $ (10) $ 24 $ 20

Common stock issued upon conversion of 3.5% Zero Coupon Convertible

Subordinated Notes ............................................. $ 2 $ 1 $ 19

Property acquired under capital leases ................................ $ 0 $ 90 $ 72

Unsettled repurchases of common stock .............................. $ 17 $ 17 $ 0

The accompanying notes are an integral part of these consolidated financial statements.

49