Costco 2011 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Key items for 2011 included:

• Net sales increased 14.2% to $87,048, driven by a 10% increase in comparable sales and

sales at the 20 net new warehouses opened in fiscal 2011. Net sales were favorably

impacted by increases in the price of gasoline and by foreign currencies strengthening

against the U.S. dollar;

• Membership fees increased 10.4% to $1,867, primarily due to the increased penetration of

the higher-fee Executive Membership program and new membership sign-ups;

• Gross margin (net sales less merchandise costs) as a percentage of net sales decreased 14

basis points and included a pre-tax last in, first out (LIFO) inventory charge of $87. There

was no LIFO charge in 2010;

• Selling, general and administrative (SG&A) expenses as a percentage of net sales

decreased 31 basis points;

• Net income attributable to Costco increased 12.2% to $1,462, or $3.30 per diluted share

compared to $1,303, or $2.92 per diluted share in 2010. The previously mentioned LIFO

charge negatively impacted diluted earnings per share by $0.12;

• The Board of Directors approved an increase in the quarterly cash dividend from $0.205 to

$0.24 per share;

• We repurchased 8,939,000 shares of our common stock, at an average cost of $71.74 per

share, totaling approximately $641;

• The Board of Directors authorized the repurchase of an additional $4,000 of our common

stock under a repurchase program expiring in April 2015; and

• In August 2011, we announced the retirement of Jim Sinegal as our Chief Executive Officer,

effective January 1, 2012. The Board of Directors elected Craig Jelinek, currently President

and Chief Operating Officer, as President and Chief Executive Officer effective January 1,

2012. Mr. Sinegal will remain with Costco in an advisory role until February 2013. In addition,

he will continue to serve on the Board of Directors.

Certain percentages presented are calculated using actual results prior to rounding. Unless otherwise

noted, references to net income relate to net income attributable to Costco.

Only the 2011 data in the accompanying tables includes Mexico.

Results of Operations

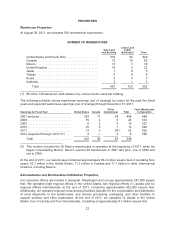

Net Sales

2011 2010 2009

Net sales .................................... $87,048 $76,255 $69,889

Net sales increase (decrease) .................. 14.2% 9.1% (1.5%)

Increase (decrease) in comparable sales ......... 10% 7% (4%)

Warehouse openings, net ...................... 20 13 15

2011 vs. 2010

Net Sales

Net sales increased $10,793 or 14.2% during 2011 compared to 2010. Excluding sales of Mexico, the

increase would have been 11%. This increase was primarily attributable to an increase in comparable

warehouse sales, and the remainder primarily from sales at the 20 net new warehouses opened during

27