Costco 2011 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are subject to change upon further review, it is our current intention to spend approximately $1,400 to

$1,600 during fiscal 2012 for real estate, construction, remodeling, and equipment for warehouses and

related operations. These expenditures are expected to be financed with a combination of cash

provided from operations and existing cash and cash equivalents and short-term investments.

We plan to open up to 20 net new warehouses in 2012, and at least one relocation of an existing

warehouse to a larger and better-located facility. In addition, the closed warehouse in Japan is

expected to re-open in the third quarter of fiscal 2012.

We opened 20 net new warehouses in 2011 and spent $1,290 on capital expenditures.

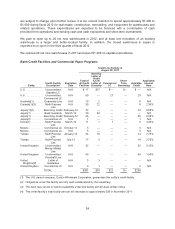

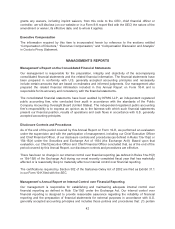

Bank Credit Facilities and Commercial Paper Programs

Credit Facility

Description

Expiration

Date

Credit Line Activity at

August 28, 2011

Applicable

Interest

RateEntity

Total of

all Credit

Facilities

Stand-by

Letter of

Credit

(LC) &

Letter of

Guaranty

Commercial

LC

Short-

Term

Borrowing

Available

Credit

U.S. ............ Uncommitted

Standby LC

N/A $ 17 $17 $— $— $ — N/A

U.S. ............ Uncommitted

Commercial LC

N/A 50 — 21 — 29 N/A

Australia(1) ...... Guarantee Line N/A 10 2 — — 8 N/A

Canada(1)(3) ..... Multi-Purpose

Line

N/A 30 22 — — 8 2.35%

Japan(1)(4) ...... Revolving Credit February-12 72 — — — 72 0.58%

Japan(1) ........ Bank Guaranty March-12 20 20 — — — N/A

Japan(1) ........ Revolving Credit February-12 46 — — — 46 0.58%

Japan(2) ........ Commercial LC N/A 1 — — — 1 N/A

Korea(1) ........ Multi-Purpose

Line

March-12 11 1 1 — 9 4.39%

Mexico .......... Commercial LC October-11 3 — — — 3 N/A

Mexico .......... Commercial LC N/A 3 — — — 3 N/A

Taiwan .......... Multi-Purpose

Line

January-12 24 10 — — 14 2.75%

Taiwan .......... Multi-Purpose

Line

July-12 17 3 — — 14 2.79%

United Kingdom . . Uncommitted

Money Market

Line

N/A 32 — — — 32 3.10%

United Kingdom . . Uncommitted

Overdraft Line

N/A 49 — — — 49 1.50%

United

Kingdom(2) ....

Letter of

Guarantee

N/A 3 3 — — — N/A

United Kingdom . . Commercial LC N/A 3 1 — — 2 N/A

TOTAL ................... $391 $79 $22 $— $290

(1) The U.S. parent company, Costco Wholesale Corporation, guarantees this entity’s credit facility.

(2) Obligations under this facility are fully cash-collateralized by the subsidiary.

(3) The bank may cancel or restrict availability under this facility with 45-days written notice.

(4) This credit facility’s total facility amount will decrease to approximately $26 in November 2011.

34