Costco 2011 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.grants any waivers, including implicit waivers, from this code to the CEO, chief financial officer or

controller, we will disclose (on our website or in a Form 8-K report filed with the SEC) the nature of the

amendment or waiver, its effective date, and to whom it applies.

Executive Compensation

The information required by this item is incorporated herein by reference to the sections entitled

“Compensation of Directors,” “Executive Compensation,” and “Compensation Discussion and Analysis”

in Costco’s Proxy Statement.

MANAGEMENT’S REPORTS

Management’s Report on the Consolidated Financial Statements

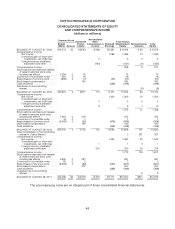

Our management is responsible for the preparation, integrity and objectivity of the accompanying

consolidated financial statements and the related financial information. The financial statements have

been prepared in conformity with U.S. generally accepted accounting principles and necessarily

include certain amounts that are based on estimates and informed judgments. Our management also

prepared the related financial information included in this Annual Report on Form 10-K and is

responsible for its accuracy and consistency with the financial statements.

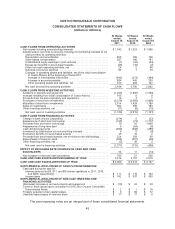

The consolidated financial statements have been audited by KPMG LLP, an independent registered

public accounting firm, who conducted their audit in accordance with the standards of the Public

Company Accounting Oversight Board (United States). The independent registered public accounting

firm’s responsibility is to express an opinion as to the fairness with which such financial statements

present our financial position, results of operations and cash flows in accordance with U.S. generally

accepted accounting principles.

Disclosure Controls and Procedures

As of the end of the period covered by this Annual Report on Form 10-K, we performed an evaluation

under the supervision and with the participation of management, including our Chief Executive Officer

and Chief Financial Officer, of our disclosure controls and procedures (as defined in Rules 13a-15(e) or

15d-15(e) under the Securities and Exchange Act of 1934 (the Exchange Act)). Based upon that

evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, as of the end of the

period covered by this Annual Report, our disclosure controls and procedures are effective.

There has been no change in our internal control over financial reporting (as defined in Rules 13a-15(f)

or 15d-15(f) of the Exchange Act) during our most recently completed fiscal year that has materially

affected or is reasonably likely to materially affect our internal control over financial reporting.

The certifications required by Section 302 of the Sarbanes-Oxley Act of 2002 are filed as Exhibit 31.1

in our Form 10-K filed with the SEC.

Management’s Annual Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over

financial reporting as defined in Rule 13a-15(f) under the Exchange Act. Our internal control over

financial reporting is designed to provide reasonable assurance regarding the reliability of financial

reporting and the preparation of financial statements for external purposes in accordance with U.S.

generally accepted accounting principles and includes those policies and procedures that: (1) pertain

42