Costco 2011 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

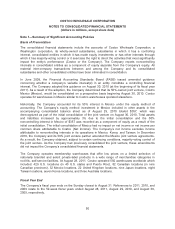

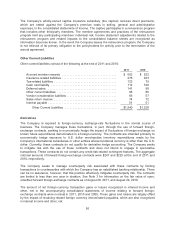

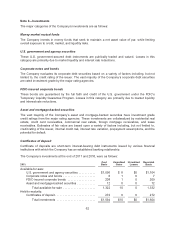

Receivables, net

Receivables consist of the following at the end of 2011 and 2010:

2011 2010

Vendor receivables, and other .................................. $487 $448

Reinsurance receivables ....................................... 201 196

Receivables from governmental entities ........................... 98 64

Other receivables ............................................. 96 103

Third-party pharmacy receivables ................................ 86 75

Allowance for doubtful accounts ................................. (3) (2)

Receivables, Net .......................................... $965 $884

Vendor receivables include payments from vendors in the form of volume rebates or other purchase

discounts that are evidenced by signed agreements and are reflected in the carrying value of the

inventory when earned or as the Company progresses towards earning the rebate or discount and as a

component of merchandise costs as the merchandise is sold. Vendor receivable balances are

generally presented on a gross basis separate from any related payable due. In certain circumstances,

these receivables may be settled against the related payable to that vendor. Other consideration

received from vendors is generally recorded as a reduction of merchandise costs upon completion of

contractual milestones, terms of the related agreement, or by other systematic approach.

Reinsurance receivables are held by the Company’s wholly-owned captive insurance subsidiary. The

receivable balance represents amounts ceded through reinsurance arrangements, and are reflected on

a gross basis, separate from the amounts assumed under reinsurance, which are presented on a gross

basis within other current liabilities on the consolidated balance sheets.

Receivables from governmental entities largely consists of various tax related items.

Third-party pharmacy receivables generally relate to amounts due from members’ insurance

companies for the amount above their co-pay, which is collected at the point-of-sale.

Amounts are recorded net of an allowance for doubtful accounts. Management determines the

allowance for doubtful accounts based on historical experience and application of the specific

identification method. Write-offs of receivables were immaterial for fiscal years 2011, 2010, or 2009.

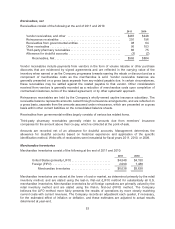

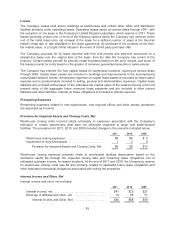

Merchandise Inventories

Merchandise inventories consist of the following at the end of 2011 and 2010:

2011 2010

United States (primarily LIFO) ......................... $4,548 $4,150

Foreign (FIFO) ..................................... 2,090 1,488

Merchandise Inventories ......................... $6,638 $5,638

Merchandise inventories are valued at the lower of cost or market, as determined primarily by the retail

inventory method, and are stated using the last-in, first-out (LIFO) method for substantially all U.S.

merchandise inventories. Merchandise inventories for all foreign operations are primarily valued by the

retail inventory method and are stated using the first-in, first-out (FIFO) method. The Company

believes the LIFO method more fairly presents the results of operations by more closely matching

current costs with current revenues. The Company records an adjustment each quarter, if necessary,

for the estimated effect of inflation or deflation, and these estimates are adjusted to actual results

determined at year-end.

53