Costco 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Due to inflation in 2011, the merchandise inventories valued at LIFO were lower than the FIFO value,

resulting in a charge to merchandise costs of $87. During 2009, due to overall net deflationary trends,

the Company recorded a $32 benefit to merchandise costs to adjust inventories valued at LIFO. At the

end of 2010, merchandise inventories valued at LIFO approximated FIFO after considering the lower of

cost or market principle.

The Company provides for estimated inventory losses between physical inventory counts as a

percentage of net sales, using estimates based on the Company’s experience. The provision is

adjusted periodically to reflect the results of the actual physical inventory counts, which generally occur

in the second and fourth fiscal quarters of the fiscal year. Inventory cost, where appropriate, is reduced

by estimates of vendor rebates when earned or as the Company progresses towards earning those

rebates, provided that they are probable and reasonably estimable.

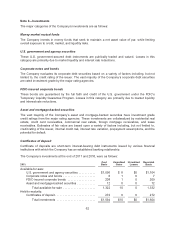

Property and Equipment

Property and equipment are stated at cost. In general, new building additions are separated into

components, each with its own estimated useful life. Depreciation and amortization expense is

computed using the straight-line method over estimated useful lives or the lease term, if shorter.

Leasehold improvements incurred after the beginning of the initial lease term are depreciated over the

shorter of the estimated useful life of the asset or the remaining term of the initial lease plus any

renewals that are reasonably assured at the date the leasehold improvement is made.

Estimated useful lives for financial reporting purposes are as follows:

Years

Buildings and improvements ....................................... 5-50

Equipment and fixtures ........................................... 3-20

Repair and maintenance costs are expensed when incurred. Expenditures for remodels,

refurbishments and improvements that add to or change the way an asset functions or that extend the

useful life of an asset are capitalized. Assets that were removed during the remodel, refurbishment or

improvement are retired. When assets are retired or sold, the asset costs and related accumulated

depreciation are eliminated, with any remaining gain or loss recorded.

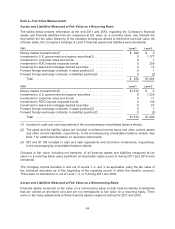

Impairment of Long-Lived Assets

The Company periodically evaluates long-lived assets for impairment when relocating or closing a

warehouse or when events or changes in circumstances occur that may indicate the carrying amount

of the asset group, generally an individual warehouse, may not be fully recoverable. For asset groups

to be held and used, including warehouses to be relocated, the carrying value of the asset group is

considered recoverable when the estimated future undiscounted cash flows generated from the use

and eventual disposition of the asset group exceed the group’s net carrying value. In the event that the

carrying value is not considered recoverable, an impairment loss would be recognized for the asset

group to be held and used equal to the excess of the carrying value above the estimated fair value of

the asset group. For asset groups classified as held for sale (disposal group), the carrying value is

compared to the disposal group’s fair value less costs to sell. The Company estimates fair value by

obtaining market appraisals from third party brokers or other valuation techniques. In 2011, 2010, and

2009, the Company recorded impairment charges of $1, $2, and $11, respectively, included in

provision for impaired assets and closing costs, net and interest income and other in the consolidated

statements of income. In 2009, the charge was primarily related to the closure of its two Costco Home

locations in July 2009.

Assets classified as held for sale were not material as of August 28, 2011 or August 29, 2010.

54