Costco 2011 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

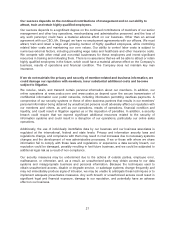

At the beginning of fiscal 2011, we began consolidating our 50% owned Mexico joint venture (Mexico)

on a prospective basis due to the adoption of a new accounting standard. Mexico’s results for the prior

years were accounted for under the equity method and our 50% share was included in “interest income

and other” in the consolidated statements of income. In the current year, the financial position and

results of Mexico’s operations are fully consolidated and the joint venture partner’s 50% share is

included in “net income attributable to noncontrolling interests” in the consolidated statements of

income of this Report. The initial consolidation of Mexico increased total assets, liabilities, and revenue

by approximately 3%, with no impact on net income or net income per common share attributable to

Costco. See discussion in Note 1 to the consolidated financial statements included in this Report.

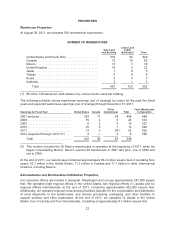

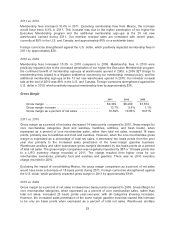

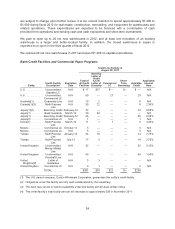

SELECTED FINANCIAL DATA

(dollars in millions, except per share and warehouse number data)

As of and for the year ended

Aug. 28, 2011

(52 weeks)

Aug. 29, 2010

(52 weeks)

Aug. 30, 2009

(52 weeks)

Aug. 31, 2008

(52 weeks)

Sept. 2, 2007

(52 weeks)

RESULTS OF OPERATIONS

Net sales .............. $87,048 $76,255 $69,889 $70,977 $63,088

Merchandise costs ...... 77,739 67,995 62,335 63,503 56,450

Gross margin ....... 9,309 8,260 7,554 7,474 6,638

Membership fees ........ 1,867 1,691 1,533 1,506 1,313

Operating income ....... 2,439 2,077 1,777 1,969 1,609

Net income attributable to

Costco .............. 1,462 1,303 1,086 1,283 1,083

Net income per diluted

common share

attributable to Costco . . 3.30 2.92 2.47 2.89 2.37

Dividends per share ..... $ 0.89 $ 0.77 $ 0.68 $ 0.61 $ 0.55

Increase (decrease) in

comparable warehouse

sales(1)

United States ........... 7% 4% (2%) 6% 5%

International ............ 16% 19% (8%) 15% 9%

Total .................. 10% 7% (4%) 8% 6%

Increase in international

comparable warehouse

sales in local currency ..... 10% 8% 7% 6% 5%

BALANCE SHEET DATA

Net property and

equipment ........... $12,432 $11,314 $10,900 $10,355 $ 9,520

Total assets ............ 26,761 23,815 21,979 20,682 19,607

Short-term borrowings . . . — 26 16 134 54

Current portion of long-

term debt ............ 900 — 80 6 60

Long-term debt, excluding

current portion ........ 1,253 2,141 2,130 2,206 2,108

Costco stockholders’

equity ............... $12,002 $10,829 $10,024 $ 9,194 $ 8,626

WAREHOUSE INFORMATION

Warehouses in Operation(2)

Beginning of year(2) ..... 572 527 512 488 458

Opened(3) ............. 24 14 19 34 30

Closed(3) .............. (4) (1) (4) (10) —

End of year ............. 592 540 527 512 488

(1) Includes net sales at warehouses open greater than one year, including relocated facilities.

(2) Excludes, in 2010 and in prior years presented, warehouses operated in Mexico through a 50% owned joint venture. Mexico

opened 30 of these warehouses in 2007 and prior, one in 2008, and one in 2009. The 2011 beginning-of-year figure

includes the 32 Mexico warehouses consolidated at the beginning of the fiscal year.

(3) Includes warehouse relocations and the closure in July 2009 of two Costco Home locations.

25