Costco 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

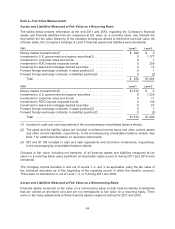

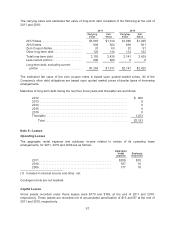

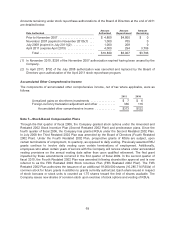

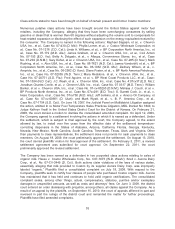

Future minimum payments, net of sub-lease income of $183 for all years combined, during the next

five fiscal years and thereafter under non-cancelable operating leases with terms of at least one year

and capital leases, at the end of 2011, were as follows:

Operating

leases

Capital lease

obligations

2012 ................................................... $ 183 $ 13

2013 ................................................... 182 13

2014 ................................................... 175 13

2015 ................................................... 162 13

2016 ................................................... 155 13

Thereafter ............................................... 1,850 311

Total ................................................ $2,707 376

Less amount representing interest ........................... (207)

Net present value of minimum lease payment .................. 169

Less current installments(1) ................................ (3)

Long-term capital lease obligations less current installments(2) . . . $ 166

(1) Included in other current liabilities.

(2) Included in deferred income taxes and other liabilities.

Certain leases may require the Company to incur costs to return leased property to its original

condition, such as the removal of gas tanks. Estimated asset retirement obligations associated with

these leases, which amounted to $31 and $26 at the end of 2011 and 2010, respectively, are recorded

and included in deferred income taxes and other liabilities on the consolidated balance sheets.

Note 6—Stockholders’ Equity

Dividends

The Company’s current quarterly dividend rate is $0.24 per share.

Stock Repurchase Programs

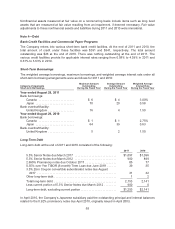

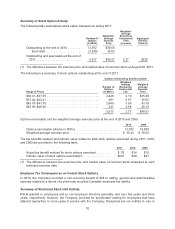

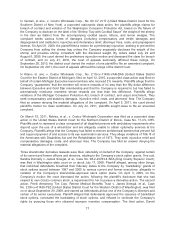

The Company’s stock repurchase activity during 2011, 2010, and 2009 is summarized in the following

table:

Shares

Repurchased

(000’s)

Average

Price per

Share

Total

Cost

2011 .......................................... 8,939 $71.74 $641

2010 .......................................... 9,943 57.14 568

2009 .......................................... 895 63.84 57

These amounts differ from the stock repurchase balances in the consolidated statements of cash flows

to the extent that repurchases had not settled at the end of the fiscal year. Purchases are made from

time-to-time, as conditions warrant, in the open market or in block purchases, and pursuant to share

repurchase plans under SEC Rule 10b5-1. Repurchased shares are retired.

68