Costco 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

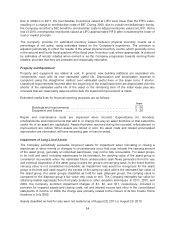

Leases

The Company leases land and/or buildings at warehouses and certain other office and distribution

facilities primarily under operating leases. Operating leases expire at various dates through 2051, with

the exception of one lease in the Company’s United Kingdom subsidiary, which expires in 2151. These

leases generally contain one or more of the following options which the Company can exercise at the

end of the initial lease term: (a) renewal of the lease for a defined number of years at the then-fair

market rental rate or rate stipulated in the lease agreement; (b) purchase of the property at the then-

fair market value; or (c) right of first refusal in the event of a third party purchase offer.

The Company accounts for its lease expense with free rent periods and step-rent provisions on a

straight-line basis over the original term of the lease, from the date the Company has control of the

property. Certain leases provide for periodic rental increases based on the price indices, and some of

the leases provide for rents based on the greater of minimum guaranteed amounts or sales volume.

The Company has entered into four capital leases for warehouse locations, expiring at various dates

through 2040. Capital lease assets are included in buildings and improvements in the accompanying

consolidated balance sheets. Amortization expense on capital lease assets is recorded as depreciation

expense and is predominately included in selling, general and administrative expenses. Capital lease

liabilities are recorded at the lesser of the estimated fair market value of the leased property or the net

present value of the aggregate future minimum lease payments and are included in other current

liabilities and other liabilities. Interest on these obligations is included in interest expense.

Preopening Expenses

Preopening expenses related to new warehouses, new regional offices and other startup operations

are expensed as incurred.

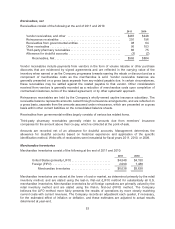

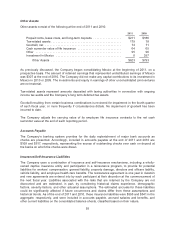

Provision for Impaired Assets and Closing Costs, Net

Warehouse closing costs incurred relate principally to expenses associated with the Company’s

relocation of certain warehouses (that were not otherwise impaired) to larger and better-located

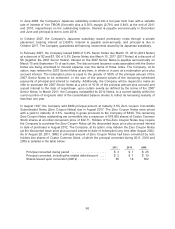

facilities. The provisions for 2011, 2010, and 2009 included charges in the amounts indicated below:

2011 2010 2009

Warehouse closing expenses .......................... $8 $6 $ 9

Impairment of long-lived assets ........................ 1 2 8

Provision for Impaired Assets and Closing Costs, Net . . $9 $8 $17

Warehouse closing expenses primarily relate to accelerated building depreciation based on the

shortened useful life through the expected closing date and remaining lease obligations, net of

estimated sublease income, for leased locations. At the end of 2011 and 2010, the Company’s reserve

for warehouse closing costs was $5 and primarily related to estimated future lease obligations and

other estimated contractual obligations associated with exiting the properties.

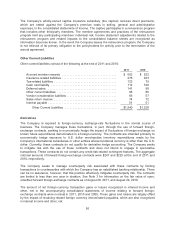

Interest Income and Other, Net

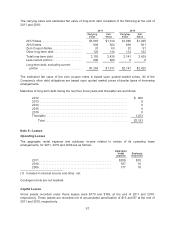

Interest income and other, net includes:

2011 2010 2009

Interest income, net .................................. $41 $23 $27

Earnings of affiliates and other, net ..................... 19 65 31

Interest Income and Other, Net ..................... $60 $88 $58

59