Costco 2011 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

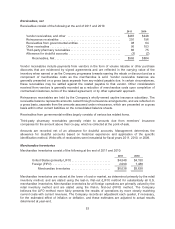

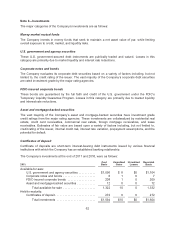

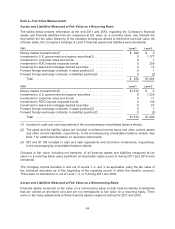

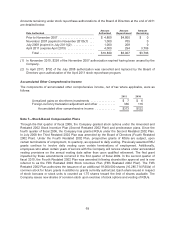

2010:

Cost

Basis

Unrealized

Gains

Unrealized

Losses

Recorded

Basis

Available-for-sale:

U.S. government and agency securities ........... $1,222 $7 $0 $1,229

Corporate notes and bonds ..................... 10 1 0 11

FDIC-insured corporate bonds .................. 139 0 0 139

Asset and mortgage-backed securities ............ 23 0 0 23

Total available-for-sale ..................... 1,394 8 0 1,402

Held-to-maturity:

Certificates of deposit .......................... 133 0 0 133

Total investments ......................... $1,527 $8 $0 $1,535

Gross unrealized gains and losses on cash equivalents were not material at August 28, 2011 and

August 29, 2010.

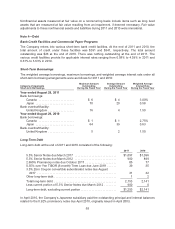

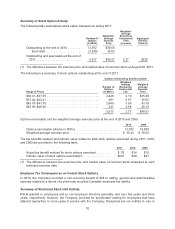

The proceeds and gross realized gains and losses from sales of available-for-sale securities during

2011, 2010, and 2009 are provided in the following table:

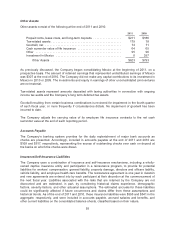

2011 2010 2009

Proceeds .......................................... $602 $309 $183

Realized gains ...................................... 1 5 5

Realized losses ..................................... 0 1 2

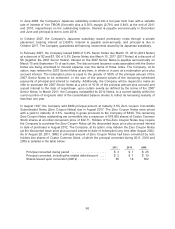

During 2009, the Company recognized $12 other-than-temporary impairment losses related to certain

enhanced money fund investment securities, which were included in interest income and other, net in

the accompanying consolidated statements of income. At the end of 2010, the Company no longer

held any of these securities. At the end of 2011 and 2010 the Company’s available-for-sale securities

that were in continuous unrealized-loss position were insignificant.

The maturities of available-for-sale and held-to-maturity securities at August 28, 2011 were as follows:

Available-For-Sale Held-To-Maturity

Cost Basis Fair Value Cost Basis Fair Value

Due in one year or less ............................ $ 890 $ 892 $272 $272

Due after one year through five years ................ 426 433 0 0

Due after five years ............................... 6 7 0 0

Total .................................... $1,322 $1,332 $272 $272

63