Costco 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

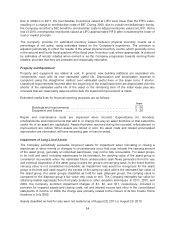

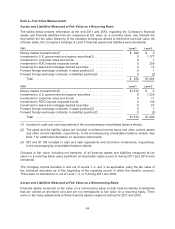

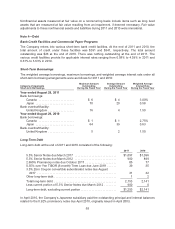

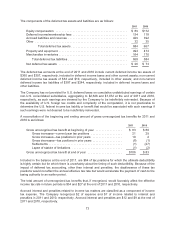

Note 3—Fair Value Measurement

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The tables below present information at the end 2011 and 2010, regarding the Company’s financial

assets and financial liabilities that are measured at fair value on a recurring basis, and indicate the

level within the fair value hierarchy of the valuation techniques utilized to determine such fair value. As

of these dates, the Company’s holdings of Level 3 financial assets and liabilities were immaterial.

2011: Level 1 Level 2

Money market mutual funds(1) ........................................ $ 200 $ 0

Investment in U.S. government and agency securities(3) ................... 0 1,177

Investment in corporate notes and bonds ............................... 0 7

Investment in FDIC-insured corporate bonds ............................ 0 209

Investment in asset and mortgage-backed securities ...................... 0 12

Forward foreign-exchange contracts, in asset position(2) .................. 0 1

Forward foreign-exchange contracts, in (liability) position(2) ................ 0 (2)

Total .......................................................... $ 200 $1,404

2010: Level 1 Level 2

Money market mutual funds(1) ........................................ $1,514 $ 0

Investment in U.S. government and agency securities ..................... 0 1,229

Investment in corporate notes and bonds ............................... 0 11

Investment in FDIC-insured corporate bonds ............................ 0 139

Investment in asset and mortgage-backed securities ...................... 0 23

Forward foreign-exchange contracts, in asset position(2) .................. 0 1

Forward foreign-exchange contracts, in (liability) position(2) ................ 0 (3)

Total .......................................................... $1,514 $1,400

(1) Included in cash and cash equivalents in the accompanying consolidated balance sheets.

(2) The asset and the liability values are included in deferred income taxes and other current assets

and other current liabilities, respectively, in the accompanying consolidated balance sheets. See

Note 1 for additional information on derivative instruments.

(3) $73 and $1,104 included in cash and cash equivalents and short-term investments, respectively,

in the accompanying consolidated balance sheets.

Changes in fair value, including net transfers, of all financial assets and liabilities measured at fair

value on a recurring basis using significant unobservable inputs (Level 3) during 2011 and 2010 were

immaterial.

The Company reports transfers in and out of Levels 1, 2, and 3, as applicable, using the fair value of

the individual securities as of the beginning of the reporting period in which the transfer occurred.

There were no transfers in or out of Level 1, 2, or 3 during 2011 and 2010.

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Financial assets measured at fair value on a nonrecurring basis include held-to-maturity investments

that are carried at amortized cost and are not remeasured to fair value on a recurring basis. There

were no fair value adjustments to these financial assets measured during the 2011 and 2010.

64