Costco 2011 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

businesses gross margins increased by three basis points as a percent of total net sales. In addition,

gross margin comparisons were negatively impacted by five basis points due to a favorable $32 LIFO

adjustment in 2009 compared to no LIFO adjustment in 2010. Increased penetration of the Executive

Membership two-percent reward program and increased spending by Executive Members negatively

affected gross margin by two basis points. Foreign currencies strengthened against the U.S. dollar in

2010, which positively impacted gross margin by approximately $183.

Selling, General and Administrative Expenses

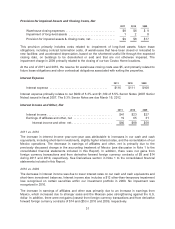

2011 2010 2009

Selling, general and administrative expenses ......... $8,682 $7,840 $7,252

SG&A as a percent of net sales .................... 9.97% 10.28% 10.38%

2011 vs. 2010

SG&A expenses as a percent of net sales decreased 31 basis points compared to 2010; excluding the

effect of gasoline price inflation on net sales, the decrease was 11 basis points. The year-over-year

decrease was due to a 15 basis point improvement in our warehouse operating costs, largely payroll.

This improvement was partially offset by a non-recurring benefit of $24, or three basis points, recorded

in fiscal 2010 related to the refund of a previously recorded Canadian employee tax liability.

The consolidation of Mexico, which compared to our other operating segments has lower SG&A

expenses as a percent of its own net sales, favorably impacted SG&A expenses as a percent of net

sales by seven basis points in 2011. Foreign currencies strengthened against the U.S. dollar, which

negatively impacted SG&A during 2011 by approximately $116.

2010 vs. 2009

SG&A expenses as a percent of net sales improved ten basis points compared to 2009; excluding the

effect of gasoline price inflation on net sales SG&A expense increased three basis points. Warehouse

operating costs, excluding the effect of gasoline price inflation, increased seven basis points, primarily

due to higher employee benefit costs, particularly employee healthcare and workers’ compensation.

SG&A expense comparisons were positively impacted by six basis points related to: a $24 refund of a

previously recorded Canadian employee tax liability; and a $23 charge recorded in 2009 to write down

the net realizable value of the cash surrender value of employee life insurance contracts with no

comparable charge in 2010. Foreign currencies strengthened against the U.S. dollar, which negatively

impacted SG&A for 2010 by approximately $140.

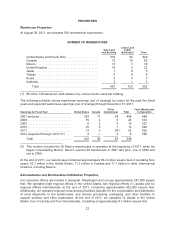

Preopening Expenses

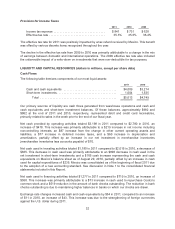

2011 2010 2009

Preopening expenses .................................... $46 $26 $41

Warehouse openings, including relocations .................. 24 14 19

Preopening expenses include costs incurred for startup operations related to new warehouses and the

expansion of ancillary operations at existing warehouses. Preopening expenses can vary due to the

number of warehouse openings, the timing of the opening relative to our year-end, whether the

warehouse is owned or leased, and whether the opening is in an existing, new, or international market.

30