Costco 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

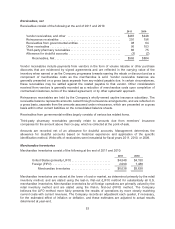

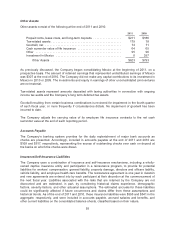

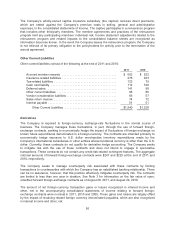

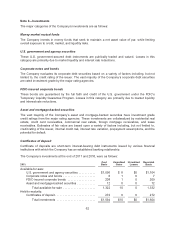

Other Assets

Other assets consist of the following at the end of 2011 and 2010:

2011 2010

Prepaid rents, lease costs, and long-term deposits .................. $211 $186

Tax-related assets ............................................. 179 18

Goodwill, net ................................................. 74 71

Cash surrender value of life insurance ............................ 64 65

Other ....................................................... 95 96

Investment in Mexico .......................................... 0 357

Other Assets ............................................. $623 $793

As previously discussed, the Company began consolidating Mexico at the beginning of 2011, on a

prospective basis. The amount of retained earnings that represented undistributed earnings of Mexico

was $307 at the end of 2010. The Company did not make any capital contributions to its investment in

Mexico in 2010 or 2009. The investments and equity in earnings of other unconsolidated joint ventures

are not material.

Tax-related assets represent amounts deposited with taxing authorities in connection with ongoing

income tax audits and the Company’s long term deferred tax assets.

Goodwill resulting from certain business combinations is reviewed for impairment in the fourth quarter

of each fiscal year, or more frequently if circumstances dictate. No impairment of goodwill has been

incurred to date.

The Company adjusts the carrying value of its employee life insurance contracts to the net cash

surrender value at the end of each reporting period.

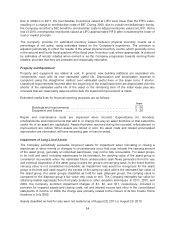

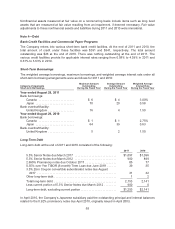

Accounts Payable

The Company’s banking system provides for the daily replenishment of major bank accounts as

checks are presented. Accordingly, included in accounts payable at the end of 2011 and 2010 are

$108 and $617, respectively, representing the excess of outstanding checks over cash on deposit at

the banks on which the checks were drawn.

Insurance/Self-Insurance Liabilities

The Company uses a combination of insurance and self-insurance mechanisms, including a wholly-

owned captive insurance entity and participation in a reinsurance program, to provide for potential

liabilities for workers’ compensation, general liability, property damage, directors and officers liability,

vehicle liability, and employee health care benefits. The reinsurance agreement is one year in duration

and new agreements are entered into by each participant at their discretion at the commencement of

the next fiscal year. Liabilities associated with the risks that are retained by the Company are not

discounted and are estimated, in part, by considering historical claims experience, demographic

factors, severity factors, and other actuarial assumptions. The estimated accruals for these liabilities

could be significantly affected if future occurrences and claims differ from these assumptions and

historical trends. As of the end of 2011 and 2010, these insurance liabilities were $595 and $541 in the

aggregate, respectively, and were included in accounts payable, accrued salaries and benefits, and

other current liabilities on the consolidated balance sheets, classified based on their nature.

55