Costco 2011 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

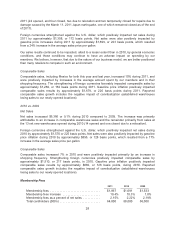

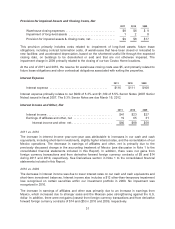

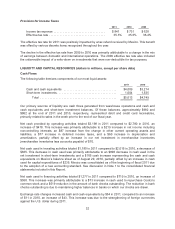

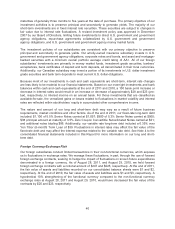

Provision for Impaired Assets and Closing Costs, Net

2011 2010 2009

Warehouse closing expenses ................................ $8 $6 $ 9

Impairment of long-lived assets .............................. 1 2 8

Provision for impaired assets & closing costs, net ................ $9 $8 $17

This provision primarily includes costs related to: impairment of long-lived assets; future lease

obligations, including contract termination costs, of warehouses that have been closed or relocated to

new facilities; and accelerated depreciation, based on the shortened useful life through the expected

closing date, on buildings to be demolished or sold and that are not otherwise impaired. The

impairment charge in 2009 primarily related to the closing of our two Costco Home locations.

At the end of 2011 and 2010, the reserve for warehouse closing costs was $5, and primarily related to

future lease obligations and other contractual obligations associated with exiting the properties.

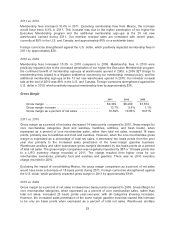

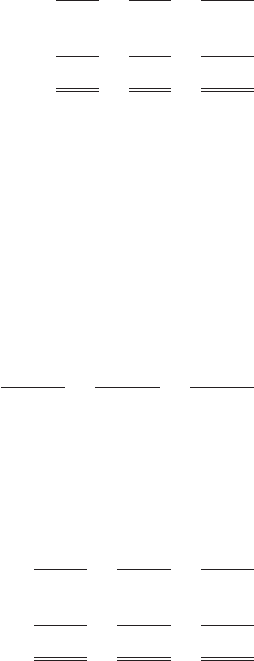

Interest Expense

2011 2010 2009

Interest expense ..................................... $116 $111 $108

Interest expense primarily relates to our $900 of 5.3% and $1,100 of 5.5% Senior Notes (2007 Senior

Notes) issued in fiscal 2007. The 5.3% Senior Notes are due March 15, 2012.

Interest Income and Other, Net

2011 2010 2009

Interest income.......................................... $41 $23 $27

Earnings of affiliates and other, net ......................... 19 65 31

Interest income and other, net .......................... $60 $88 $58

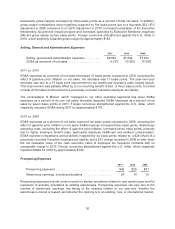

2011 vs. 2010

The increase in interest income year-over-year was attributable to increases in our cash and cash

equivalents, including short-term investments, slightly higher interest rates, and the consolidation of our

Mexico operations. The decrease in earnings of affiliates and other, net is primarily due to the

previously discussed change in the accounting treatment of Mexico (see discussion in Note 1 to the

consolidated financial statements included in this Report). In addition, there were net gains from

foreign currency transactions and from derivative forward foreign currency contracts of $9 and $14

during 2011 and 2010, respectively. See Derivatives section in Note 1 to the consolidated financial

statements included in this Report.

2010 vs. 2009

The decrease in interest income was due to lower interest rates on our cash and cash equivalents and

short-term investment balances. Interest income also includes a $12 other-than-temporary impairment

loss recognized on certain securities within our investment portfolio in 2009. No impairment was

recognized in 2010.

The increase in earnings of affiliates and other was primarily due to an increase in earnings from

Mexico, which increased due to stronger sales and the Mexican peso strengthening against the U.S.

dollar. In addition, there were net gains (losses) from foreign currency transactions and from derivative

forward foreign currency contracts of $14 and ($5) in 2010 and 2009, respectively.

31