Costco 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

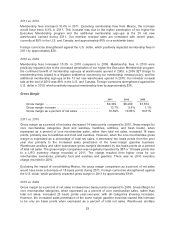

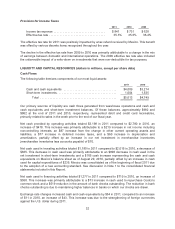

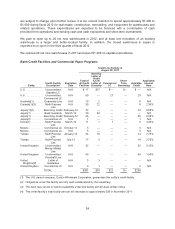

Provision for Income Taxes

2011 2010 2009

Income tax expense ................................. $841 $731 $628

Effective tax rate .................................... 35.3% 35.6% 36.4%

The effective tax rate for 2011 was positively impacted by a tax refund received by Mexico. This benefit

was offset by various discrete items recognized throughout the year.

The decline in the effective tax rate from 2009 to 2010 was primarily attributable to a change in the mix

of earnings between domestic and international operations. The 2009 effective tax rate also included

the unfavorable impact of a write-down on investments that were non-deductible for tax purposes.

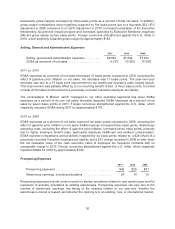

LIQUIDITY AND CAPITAL RESOURCES (dollars in millions, except per share data)

Cash Flows

The following table itemizes components of our most liquid assets:

2011 2010

Cash and cash equivalents .................................. $4,009 $3,214

Short-term investments ...................................... 1,604 1,535

Total ................................................. $5,613 $4,749

Our primary sources of liquidity are cash flows generated from warehouse operations and cash and

cash equivalents and short-term investment balances. Of these balances, approximately $982 and

$862 at the end of 2011 and 2010, respectively, represented debit and credit card receivables,

primarily related to sales in the week prior to the end of our fiscal year.

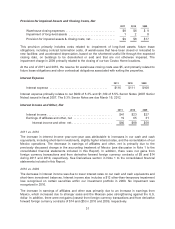

Net cash provided by operating activities totaled $3,198 in 2011 compared to $2,780 in 2010, an

increase of $418. This increase was primarily attributable to a $219 increase in net income including

noncontrolling interests, an $87 increase from the change in other current operating assets and

liabilities, a $77 increase in deferred income taxes, and a $60 increase in depreciation and

amortization, partially offset by an increase in our net investment in merchandise inventories

(merchandise inventories less accounts payable) of $70.

Net cash used in investing activities totaled $1,180 in 2011 compared to $2,015 in 2010, a decrease of

$835. This decrease in cash used was primarily attributable to an $896 decrease in cash used in the

net investment in short-term investments and a $165 cash increase representing the cash and cash

equivalents on Mexico’s balance sheet as of August 29, 2010, partially offset by an increase in cash

used for capital expenditures of $235. Mexico was consolidated as of the beginning of fiscal 2011 due

to the adoption of a new accounting standard. See discussion in Note 1 to the consolidated financial

statements included in this Report.

Net cash used in financing activities totaled $1,277 in 2011 compared to $719 in 2010, an increase of

$558. This increase was primarily attributable to a $73 increase in cash used to repurchase Costco’s

common stock and a $519 reduction in the amount of bank checks outstanding. The reduction in bank

checks outstanding is due to maintaining higher balances in banks on which our checks are drawn.

Exchange rate changes increased cash and cash equivalents by $54 in 2011, compared to an increase

of $11 in 2010, an increase of $43. This increase was due to the strengthening of foreign currencies

against the U.S. dollar during 2011.

32