Costco 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

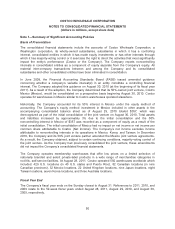

The Company’s wholly-owned captive insurance subsidiary (the captive) receives direct premiums,

which are netted against the Company’s premium costs in selling, general and administrative

expenses, in the consolidated statements of income. The captive participates in a reinsurance program

that includes other third-party members. The member agreements and practices of the reinsurance

program limit any participating members’ individual risk. Income statement adjustments related to the

reinsurance program and related impacts to the consolidated balance sheets are recognized as

information becomes known. In the event the Company leaves the reinsurance program, the Company

is not relieved of its primary obligation to the policyholders for activity prior to the termination of the

annual agreement.

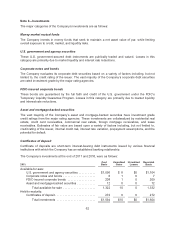

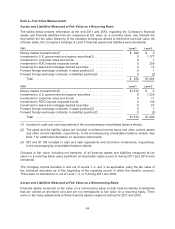

Other Current Liabilities

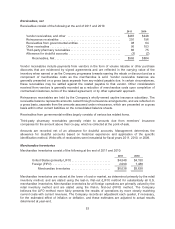

Other current liabilities consist of the following at the end of 2011 and 2010:

2011 2010

Accrued member rewards ................................... $ 602 $ 522

Insurance-related liabilities ................................... 276 263

Tax-related liabilities ........................................ 122 79

Cash card liability .......................................... 112 100

Deferred sales ............................................. 141 98

Other current liabilities ...................................... 96 86

Vendor consideration liabilities ................................ 66 57

Sales return reserve ........................................ 74 72

Interest payable ............................................ 51 51

Other Current Liabilities ................................. $1,540 $1,328

Derivatives

The Company is exposed to foreign-currency exchange-rate fluctuations in the normal course of

business. The Company manages these fluctuations, in part, through the use of forward foreign-

exchange contracts, seeking to economically hedge the impact of fluctuations of foreign exchange on

known future expenditures denominated in a foreign-currency. The contracts are intended primarily to

economically hedge exposure to U.S. dollar merchandise inventory expenditures made by the

Company’s international subsidiaries or other entities whose functional currency is other than the U.S.

dollar. Currently, these contracts do not qualify for derivative hedge accounting. The Company seeks

to mitigate risk with the use of these contracts and does not intend to engage in speculative

transactions. These contracts do not contain any credit-risk-related contingent features. The aggregate

notional amounts of forward foreign-exchange contracts were $247 and $225 at the end of 2011 and

2010, respectively.

The Company seeks to manage counterparty risk associated with these contracts by limiting

transactions to counterparties with which the Company has an established banking relationship. There

can be no assurance, however, that this practice effectively mitigates counterparty risk. The contracts

are limited to less than one year in duration. See Note 3 for information on the fair value of open,

unsettled forward foreign-exchange contracts as of August 28, 2011, and August 29, 2010.

The amount of net foreign-currency transaction gains or losses recognized in interest income and

other, net in the accompanying consolidated statements of income relating to forward foreign-

exchange contracts were nominal in 2011, 2010 and 2009. These gains and losses are largely offset

by the impact of revaluing related foreign currency denominated payables, which are also recognized

in interest income and other, net.

56