Costco 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

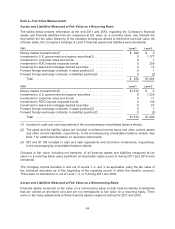

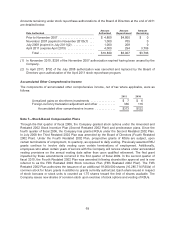

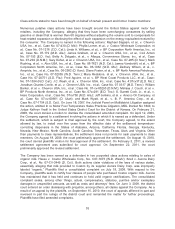

Amounts remaining under stock repurchase authorizations of the Board of Directors at the end of 2011

are detailed below:

Date Authorized

Amount

Authorized

Amount

Repurchased

Amount

Remaining

Prior to November 2007 ....................... $ 4,800 $4,800 $ 0

November 2007 (expired in November 2010)(1) . . . 1,000 705 0

July 2008 (expired in July 2011)(2) .............. 1,000 208 0

April 2011 (expires April 2015) ................. 4,000 294 3,706

Total ................................... $10,800 $6,007 $3,706

(1) In November 2010, $295 of the November 2007 authorization expired having been unused by the

Company.

(2) In April 2011, $792 of the July 2008 authorization was cancelled and replaced by the Board of

Directors upon authorization of the April 2011 stock repurchase program.

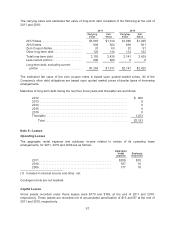

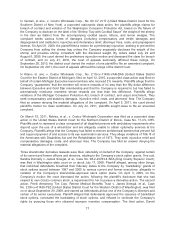

Accumulated Other Comprehensive Income

The components of accumulated other comprehensive income, net of tax where applicable, were as

follows:

2011 2010

Unrealized gains on short-term investments ................ $ 7 $ 6

Foreign-currency translation adjustment and other ........... 366 116

Accumulated other comprehensive income ............. $373 $122

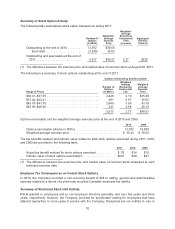

Note 7—Stock-Based Compensation Plans

Through the first quarter of fiscal 2006, the Company granted stock options under the Amended and

Restated 2002 Stock Incentive Plan (Second Restated 2002 Plan) and predecessor plans. Since the

fourth quarter of fiscal 2006, the Company has granted RSUs under the Second Restated 2002 Plan.

In July 2008 the Third Restated 2002 Plan was amended by the Board of Directors (Fourth Restated

2002 Plan). Under the Fourth Restated 2002 Plan, prospective grants of RSUs are subject, upon

certain terminations of employment, to quarterly, as opposed to daily vesting. Previously awarded RSU

grants continue to involve daily vesting upon certain terminations of employment. Additionally,

employees who attain certain years of service with the Company will receive shares under accelerated

vesting provisions on the annual vesting date rather than upon qualified retirement. The first grant

impacted by these amendments occurred in the first quarter of fiscal 2009. In the second quarter of

fiscal 2010, the Fourth Restated 2002 Plan was amended following shareholder approval and is now

referred to as the Fifth Restated 2002 Stock Incentive Plan (Fifth Restated 2002 Plan). The Fifth

Restated 2002 Plan authorizes the issuance of an additional 18,000,000 shares (10,285,714 RSUs) of

common stock for future grants in addition to grants currently authorized. Each share issued in respect

of stock bonuses or stock units is counted as 1.75 shares toward the limit of shares available. The

Company issues new shares of common stock upon exercise of stock options and vesting of RSUs.

69