Costco 2011 Annual Report Download - page 59

Download and view the complete annual report

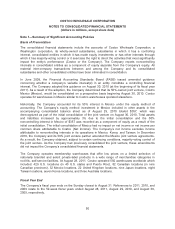

Please find page 59 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company is exposed to risks due to fluctuations in prices for the energy it consumes, particularly

electricity and natural gas, which it seeks to partially mitigate through the use of fixed-price contracts

for approximately 36% of its warehouses and other facilities, primarily in the U.S. and Canada. The

Company also enters into variable-priced contracts for some purchases of natural gas, in addition to

fuel for its gas stations, on an index basis. These contracts meet the characteristics of derivative

instruments, but generally qualify for the “normal purchases or normal sales” exception under

authoritative guidance and thus require no mark-to-market adjustment.

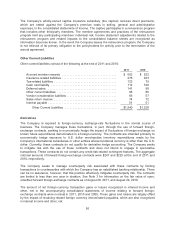

Foreign-Currency

The functional currencies of the Company’s international subsidiaries are the local currency of the

country in which the subsidiary is located. Assets and liabilities recorded in foreign currencies are

translated at the exchange rate on the balance sheet date. Translation adjustments resulting from this

process are recorded in accumulated other comprehensive income. Revenues and expenses of the

Company’s consolidated foreign operations are translated at average rates of exchange prevailing

during the year.

The Company recognizes foreign-currency transaction gains and losses related to revaluing all

monetary assets and liabilities denominated in currencies other than the functional currency, generally

the U.S. dollar payables of consolidated subsidiaries to their functional currency, in interest income and

other, net in the accompanying consolidated statements of income. These gains and losses were $8

and $13 in 2011 and 2010, respectively and not significant in 2009.

Revenue Recognition

The Company generally recognizes sales, net of estimated returns, at the time the member takes

possession of merchandise or receives services. When the Company collects payments from

customers prior to the transfer of ownership of merchandise or the performance of services, the

amounts received are generally recorded as deferred sales included in other current liabilities on the

consolidated balance sheets until the sale or service is completed. The Company reserves for

estimated sales returns based on historical trends in merchandise returns, net of the estimated net

realizable value of merchandise inventories to be returned and any estimated disposition costs.

Amounts collected from members, which under common trade practices are referred to as sales taxes,

are recorded on a net basis.

The Company evaluates whether it is appropriate to record the gross amount of merchandise sales

and related costs or the net amount earned as commissions. Generally, when Costco is the primary

obligor, is subject to inventory risk, has latitude in establishing prices and selecting suppliers, can

influence product or service specifications, or has several but not all of these indicators, revenue is

recorded on a gross basis. If the Company is not the primary obligor and does not possess other

indicators of gross reporting as noted above, it records the net amounts as commissions earned, which

is reflected in net sales.

Membership fee revenue represents annual membership fees paid by substantially all of the

Company’s members. The Company accounts for membership fee revenue, net of estimated refunds,

on a deferred basis, whereby revenue is recognized ratably over the one-year membership period. As

previously disclosed, effective with renewals occurring on and after March 1, 2009, the Company

changed an element of its membership renewal policy. Memberships renewed within two months after

expiration of the current membership year are extended for twelve months from the expiration date.

(Under the previous policy, renewals within six months of the expiration date were extended for twelve

months from the expiration date.) Memberships renewed more than two months after such expiration

date are extended for twelve months from the renewal date. This change has had an immaterial effect

of deferring recognition of certain membership fees paid by late-renewing members.

57