Costco 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

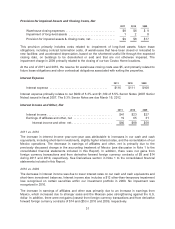

2011 vs. 2010

Membership fees increased 10.4% in 2011. Excluding membership fees from Mexico, the increase

would have been 8.3% in 2011. This increase was due to the higher penetration of our higher-fee

Executive Membership program and the additional membership sign-ups at the 20 net new

warehouses opened during 2011. Our member renewal rates are consistent with recent years,

currently at 89% in the U.S. and Canada, and approximately 86% on a worldwide basis.

Foreign currencies strengthened against the U.S. dollar, which positively impacted membership fees in

2011 by approximately $30.

2010 vs. 2009

Membership fees increased 10.3% in 2010 compared to 2009. Membership fees in 2010 were

positively impacted due to the increased penetration of our higher-fee Executive Membership program,

the continued benefit of membership sign-ups at warehouses opened in 2009, a 2009 $27 charge to

membership fees related to a litigation settlement concerning our membership renewal policy, and the

additional membership sign-ups at the 13 net new warehouses opened in 2010. Our member renewal

rate at the end of 2010 was 88% in the U.S. and Canada. Foreign currencies strengthened against the

U.S. dollar in 2010, which positively impacted membership fees by approximately $36.

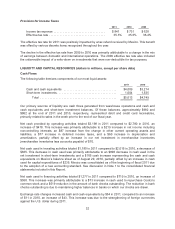

Gross Margin

2011 2010 2009

Gross margin ................................... $9,309 $8,260 $7,554

Gross margin increase ............................ 12.7% 9.4% 1.1%

Gross margin as a percent of net sales .............. 10.69% 10.83% 10.81%

2011 vs. 2010

Gross margin as a percent of net sales decreased 14 basis points compared to 2010. Gross margin for

core merchandise categories (food and sundries, hardlines, softlines, and fresh foods), when

expressed as a percent of core merchandise sales, rather than total net sales, increased 18 basis

points, primarily due to hardlines and food and sundries. However, when the core merchandise gross

margin is expressed as a percentage of total net sales, it decreased two basis points from the prior

year due primarily to the increased sales penetration of the lower-margin gasoline business.

Warehouse ancillary and other businesses gross margins decreased by two basis points as a percent

of total net sales. The gross margin comparison was negatively impacted by $87 or 10 basis points due

to a LIFO inventory charge recorded in 2011. The charge resulted from higher costs for our

merchandise inventories, primarily food and sundries and gasoline. There was no LIFO inventory

charge recorded in 2010.

Excluding the impact of consolidating Mexico, the gross margin comparison as a percent of net sales

would have been a decrease of 18 basis points during 2011. Foreign currencies strengthened against

the U.S. dollar, which positively impacted gross margin in 2011 by approximately $149.

2010 vs. 2009

Gross margin as a percent of net sales increased two basis points compared to 2009. Gross Margin for

core merchandise categories, when expressed as a percent of core merchandise sales, rather than

total net sales, increased 25 basis points year-over-year, with all categories showing increases.

However, the increased sales penetration of the lower margin gasoline business caused this increase

to be only six basis points when expressed as a percent of total net sales. Warehouse ancillary

29