Costco 2011 Annual Report Download - page 54

Download and view the complete annual report

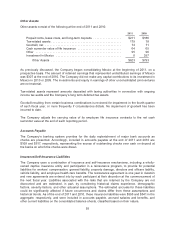

Please find page 54 of the 2011 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The following valuation techniques are used to measure fair value:

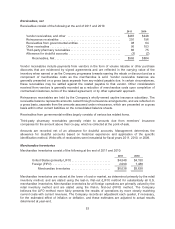

Level 1 primarily consists of financial instruments, such as money market mutual funds, whose value is

based on quoted market prices, such as quoted net asset values published by the fund as supported in

an active market, exchange-traded instruments and listed equities.

Level 2 includes assets and liabilities where quoted market prices are unobservable but observable

inputs other than Level 1 prices, such as quoted prices for similar assets or liabilities, or other inputs

that are observable or can be corroborated by observable market data for substantially the full term of

the assets or liabilities, or could be obtained from data providers or pricing vendors. The Company’s

Level 2 assets and liabilities primarily include United States (U.S.) government and agency securities,

Federal Deposit Insurance Corporation (FDIC) insured corporate bonds, investments in corporate

notes and bonds, asset and mortgage-backed securities, and forward foreign exchange contracts.

Valuation methodologies are based on “consensus pricing,” using market prices from a variety of

industry-standard independent data providers or pricing that considers various assumptions, including

time value, yield curve, volatility factors, credit spreads, default rates, loss severity, current market and

contractual prices for the underlying instruments or debt, broker and dealer quotes, as well as other

relevant economic measures. All are observable in the market or can be derived principally from or

corroborated by observable market data, for which the Company typically receives independent

external valuation information.

Level 3 is comprised of significant unobservable inputs for valuations from the Company’s independent

data and a primary pricing vendor that are also supported by little, infrequent, or no market activity.

Management considers indicators of significant unobservable inputs such as the lengthening of

maturities, later-than-scheduled payments, and any remaining individual securities that have otherwise

matured, as indicators of Level 3. Assets and liabilities are considered Level 3 when their fair value

inputs are unobservable, unavailable or management concludes that even though there may be some

observable inputs, an item should be classified as a Level 3 based on other indicators of significant

unobservable inputs, such as situations involving limited market activity, where determination of fair

value requires significant judgment or estimation. The Company utilizes the services of a primary

pricing vendor, which does not provide access to its proprietary valuation models, inputs and

assumptions. While the Company is not provided access to proprietary models of the vendor, the

Company reviewed and contrasted pricing received with other pricing sources to ensure accuracy of

each asset class for which prices are provided. The Company’s review also included an examination of

the underlying inputs and assumptions for a sample of individual securities across asset classes, credit

rating levels and various durations, a process that is continually performed for each reporting period. In

addition, the pricing vendor has an established challenge process in place for all security valuations,

which facilitates identification and resolution of potentially erroneous prices. The Company believes

that the prices received from the primary pricing vendor are representative of exit prices in accordance

with authoritative guidance, and are classified appropriately in the fair value hierarchy.

Our current financial liabilities have fair values that approximate their carrying values. Our long-term

financial liabilities consist of long-term debt, which is recorded on the balance sheet at issuance price

less unamortized discount.

52