Costco 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

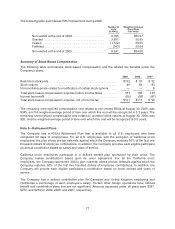

Note 12—Segment Reporting

The Company and its subsidiaries are principally engaged in the operation of membership warehouses

in the United States, Canada, Japan, Australia, the United Kingdom, and through majority-owned

subsidiaries in Taiwan and Korea and through a 50%-owned joint-venture in Mexico. The Company’s

reportable segments are based on management’s organization of the operating segments for making

operational decisions and assessments of financial performance, which considers geographic

locations. The investment in the Mexico joint-venture is only included in total assets under United

States Operations in the table below, as it is accounted for under the equity method and its operations

are not consolidated in the Company’s financial statements.

United States

Operations(a)

Canadian

Operations

Other

International

Operations Total

Year Ended August 30, 2009

Total revenue ........................... $56,548 $ 9,737 $5,137 $71,422

Operating income ....................... 1,273 354 150 1,777

Depreciation and amortization ............. 589 90 49 728

Capital expenditures, net ................. 904 135 211 1,250

Property and equipment, net ............... 8,415 1,394 1,091 10,900

Total assets ............................ 17,228 2,641 2,110 21,979

Net assets ............................. 7,458 1,470 1,090 10,018

Year Ended August 31, 2008

Total revenue ........................... $56,903 $10,528 $5,052 $72,483

Operating income ....................... 1,393 420 156 1,969

Depreciation and amortization ............. 511 92 50 653

Capital expenditures, net ................. 1,190 246 163 1,599

Property and equipment, net ............... 8,016 1,371 968 10,355

Total assets ............................ 16,345 2,477 1,860 20,682

Net assets ............................. 6,882 1,292 1,018 9,192

Year Ended September 2, 2007

Total revenue ........................... $51,532 $ 8,724 $4,145 $64,401

Operating income ....................... 1,217 287(b) 105 1,609

Depreciation and amortization ............. 449 73 44 566

Capital expenditures, net ................. 1,105 207 74 1,386

Property and equipment, net ............... 7,357 1,237 926 9,520

Total assets ............................ 15,577 2,280 1,750 19,607

Net assets ............................. 6,451 1,157 1,015 8,623

The material accounting policies of the segments are the same as those described in Note 1. All inter-

segment net sales and expenses are immaterial and have been eliminated in computing total revenue

and operating income.

(a) Certain home office operating expenses are incurred on behalf of the Company’s Canadian and

other international operations, but are included in the United States operations above because

those costs are not allocated internally and generally come under the responsibility of the

Company’s United States management team.

(b) Includes a $39 charge related to protecting employees from adverse tax consequences resulting

from the Company’s internal review of its historical stock option grant practices in 2006 of certain

stock options (See Note 7).

87