Costco 2009 Annual Report Download - page 61

Download and view the complete annual report

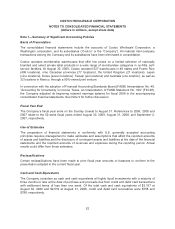

Please find page 61 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.months from the expiration date.) Memberships renewed more than two months after such expiration

date are extended for twelve months from the renewal date. Although this change will have the effect

of deferring recognition of certain membership fees paid by late-renewing members, the effect is not

expected to be material.

The Company’s Executive members qualify for a 2% reward, which can be redeemed at Costco

warehouses, up to a maximum of $500 per year, on all qualified purchases made at Costco. The

Company accounts for this 2% reward as a reduction in sales, with the related liability being classified

within other current liabilities. The sales reduction and corresponding liability are computed after giving

effect to the estimated impact of non-redemptions based on historical data. The reduction in sales was

$610, $571, and $488 in 2009, 2008, and 2007, respectively.

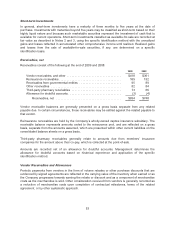

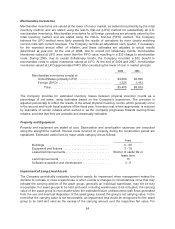

Merchandise Costs

Merchandise costs consist of the purchase price of inventory sold, inbound shipping charges and all

costs related to the Company’s depot operations, including freight from depots to selling warehouses,

and are reduced by vendor consideration received. Merchandise costs also include salaries, benefits

and depreciation on production equipment in certain fresh foods and ancillary departments.

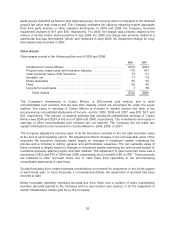

Selling, General and Administrative Expenses

Selling, general and administrative expenses consist primarily of salaries, benefits and workers’

compensation costs for warehouse employees, other than fresh foods departments and certain

ancillary businesses, as well as all regional and home office employees, including buying personnel.

Selling, general and administrative expenses also include utilities, bank charges, rent and substantially

all building and equipment depreciation, as well as other operating costs incurred to support

warehouse operations.

Marketing and Promotional Expenses

Costco’s policy is generally to limit marketing and promotional expenses to new warehouse openings,

occasional direct mail marketing to prospective new members and direct mail marketing programs to

existing members promoting selected merchandise. Marketing and promotional costs are expensed as

incurred and are included in selling, general and administrative, and preopening expenses in the

accompanying consolidated statements of income.

Stock-Based Compensation

Compensation expense for all stock-based awards granted is recognized using the straight-line

method. The fair value of restricted stock units (RSUs) is calculated as the market value of the

common stock on the measurement date less the present value of the expected dividends forgone

during the vesting period. The fair value of stock options is measured using the Black-Scholes

valuation model. While options and RSUs granted to employees generally vest over five years, all

grants allow for either daily or quarterly vesting of the pro-rata number of stock-based awards that

would vest on the next anniversary of the grant date in the event of retirement or voluntary termination.

The historical experience rate of actual forfeitures has been minimal. As such, the Company does not

reduce stock-based compensation for an estimate of forfeitures because the estimate is

inconsequential in light of historical experience and considering the awards vest on either a daily or

quarterly basis. The impact of actual forfeitures arising in the event of involuntary termination is

recognized as actual forfeitures occur, which generally is infrequent. Stock-based compensation

expense is included in merchandise costs and selling, general and administrative expenses on the

consolidated statements of income. See Note 7 for additional information on the Company’s stock-

based compensation plans.

59