Costco 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Costco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

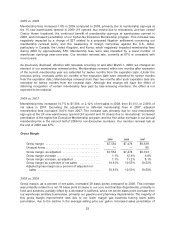

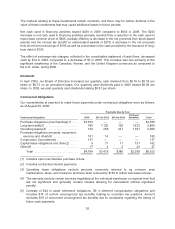

We believe disclosing the effects of these items helps provide a meaningful comparison of our current

year results to prior years. The impact of each of these items noted above is presented below:

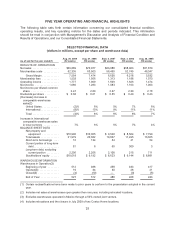

2007

Sales return

reserve

Employee tax

consequences on

stock options

Deferred

membership

Excise tax

refund Total

Net sales ......................... $(452) $ — $ — $— $(452)

Membership fees ................... — — (56) — (56)

Total revenue .................. (452) — (56) — (508)

Merchandise costs ................. 358 — — 9 367

Gross margin(1) ................ (94) — — 9 (85)

SG&A ............................ — (47) — — (47)

Operating income............... (94) (47) (56) 9 (188)

Interest expense ................... — — — — —

Interest income and other ............ (1) — — 1 —

Income before income taxes ......... (95) (47) (56) 10 (188)

Provision for income taxes ....... 35 17 21 (4) 69

Net Income ........................ $ (60) $(30) $(35) $ 6 $(119)

(1) Net sales less merchandise costs.

Results of Operations

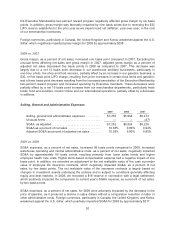

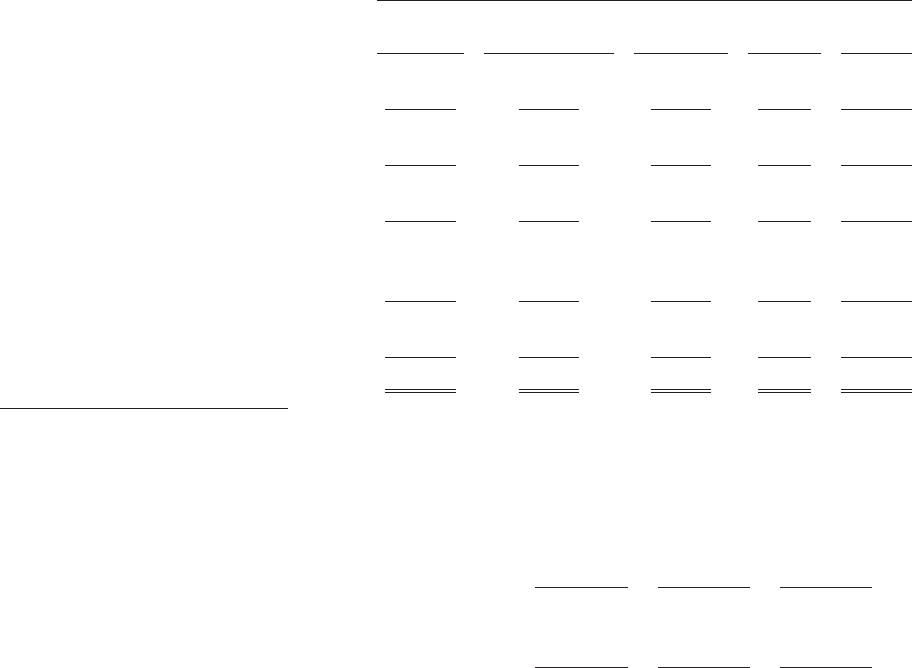

Net Sales

2009 2008 2007

Net sales .................................... $69,889 $70,977 $63,088

Effect of change in estimated sales returns

reserve ................................... — — 452

Net sales, as adjusted ......................... $69,889 $70,977 $63,540

Net sales (decrease) increase .................. (1.5)% 12.5% 7.0%

Net sales (decrease) increase, as adjusted ........ (1.5)% 11.7% 7.8%

Increase (decrease) in comparable warehouse

sales ..................................... (4)% 8% 6%

Warehouse openings, net ...................... 15 24 30

2009 vs. 2008

Net Sales

Our 2009 sales results, particularly in hardlines and softlines, were negatively impacted by general

economic conditions, and we believe that those conditions may continue to have a significant adverse

impact on spending by our members. We believe, however, that due to the nature of our business

model, we are better positioned than many retailers to compete in such an environment.

Net sales decreased 1.5% during 2009 compared to 2008. The $1,088 decrease was comprised of a

$2,590 decrease in comparable sales, partially offset by an increase of $1,502 primarily from sales at

new warehouses opened during 2009 and 2008. Our sales were also impacted by a lower number of

warehouse openings year-over-year.

27